constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

use or consumption within the Province, <strong>of</strong> goods liable to taxes by the<br />

Province on sale, turnover or purchase". This addition is suggested in order<br />

to prevent avoidance by importing for personal use from outside the<br />

province.<br />

32. One <strong>of</strong> the Provincial Memoranda has suggested that the entry "State Lotteries" should be<br />

transferred to the Provincial List, but, as we do not wish to encourage State Lotteries, we should prefer<br />

the subject to remain Central where, too, we hope, it will not be used.<br />

Shares in certain taxes<br />

33. We have no new items to suggest for insertion in the Provincial Legislative List.<br />

34. The Federal Government will levy and collect all the taxes in the Federal Legislative List. But,<br />

according to our recommendations in the following paragraphs the Centre will retain the whole <strong>of</strong> the net<br />

proceeds <strong>of</strong> the following taxes only, viz.: -<br />

(1) Duties <strong>of</strong> customs, including export duties.<br />

(2) Taxes on capital value <strong>of</strong> assets and taxes on the capital <strong>of</strong> Companies.<br />

(3) Taxes on Railway fares and freights.<br />

35. At present, the Central Government shares the net proceeds <strong>of</strong> the Jute Export duties with the<br />

jute-growing Provinces and has to hand over to the Provinces the whole <strong>of</strong> the net proceeds <strong>of</strong> taxes on<br />

railway fares and freights, if levied. As regards the latter, we recommend that, if such taxes are to be<br />

levied at all, they should be wholly Central, for, we cannot see any difference in substance between such<br />

taxes and a straight addition to fares and freights. As regards the former we are <strong>of</strong> the opinion that an<br />

export duties are capable <strong>of</strong> very limited application and have to be levied with great caution, they are<br />

unsuitable for sharing with the Provinces.<br />

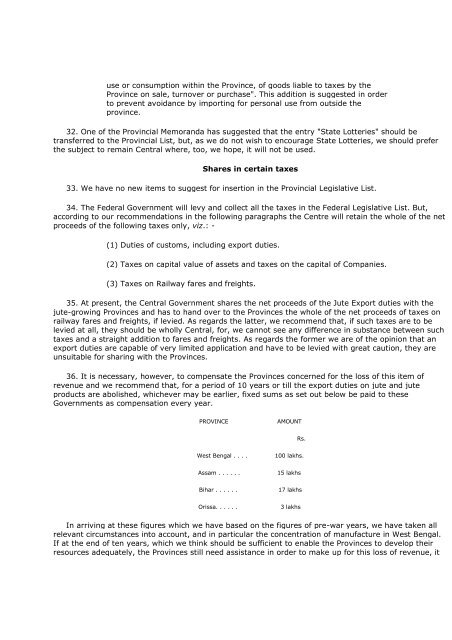

36. It is necessary, however, to compensate the Provinces concerned for the loss <strong>of</strong> this item <strong>of</strong><br />

revenue and we recommend that, for a period <strong>of</strong> 10 years or till the export duties on jute and jute<br />

products are abolished, whichever may be earlier, fixed sums as set out below be paid to these<br />

Governments as compensation every year.<br />

PROVINCE AMOUNT<br />

Rs.<br />

West Bengal . . . . 100 lakhs.<br />

Assam . . . . . . 15 lakhs<br />

Bihar . . . . . . 17 lakhs<br />

Orissa. . . . . . 3 lakhs<br />

In arriving at these figures which we have based on the figures <strong>of</strong> pre-war years, we have taken all<br />

relevant circumstances into account, and in particular the concentration <strong>of</strong> manufacture in West Bengal.<br />

If at the end <strong>of</strong> ten years, which we think should be sufficient to enable the Provinces to develop their<br />

resources adequately, the Provinces still need assistance in order to make up for this loss <strong>of</strong> revenue, it

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)