constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

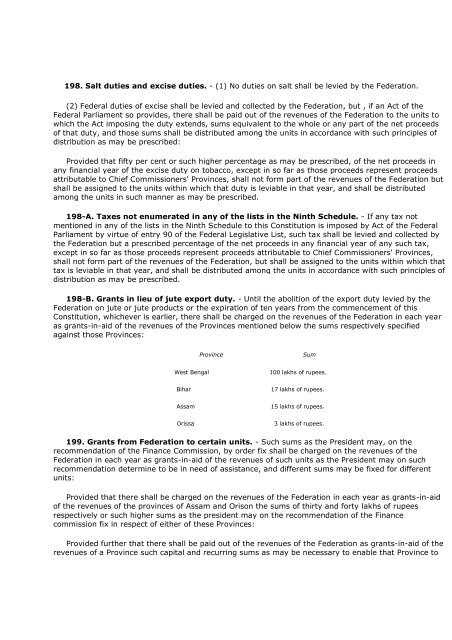

198. Salt duties and excise duties. - (1) No duties on salt shall be levied by the Federation.<br />

(2) Federal duties <strong>of</strong> excise shall be levied and collected by the Federation, but , if an Act <strong>of</strong> the<br />

Federal Parliament so provides, there shall be paid out <strong>of</strong> the revenues <strong>of</strong> the Federation to the units to<br />

which the Act imposing the duty extends, sums equivalent to the whole or any part <strong>of</strong> the net proceeds<br />

<strong>of</strong> that duty, and those sums shall be distributed among the units in accordance with such principles <strong>of</strong><br />

distribution as may be prescribed:<br />

Provided that fifty per cent or such higher percentage as may be prescribed, <strong>of</strong> the net proceeds in<br />

any financial year <strong>of</strong> the excise duty on tobacco, except in so far as those proceeds represent proceeds<br />

attributable to Chief Commissioners' Provinces, shall not form part <strong>of</strong> the revenues <strong>of</strong> the Federation but<br />

shall be assigned to the units within which that duty is leviable in that year, and shall be distributed<br />

among the units in such manner as may be prescribed.<br />

198-A. Taxes not enumerated in any <strong>of</strong> the lists in the Ninth Schedule. - If any tax not<br />

mentioned in any <strong>of</strong> the lists in the Ninth Schedule to this Constitution is imposed by Act <strong>of</strong> the Federal<br />

Parliament by virtue <strong>of</strong> entry 90 <strong>of</strong> the Federal Legislative List, such tax shall be levied and collected by<br />

the Federation but a prescribed percentage <strong>of</strong> the net proceeds in any financial year <strong>of</strong> any such tax,<br />

except in so far as those proceeds represent proceeds attributable to Chief Commissioners' Provinces,<br />

shall not form part <strong>of</strong> the revenues <strong>of</strong> the Federation, but shall be assigned to the units within which that<br />

tax is leviable in that year, and shall be distributed among the units in accordance with such principles <strong>of</strong><br />

distribution as may be prescribed.<br />

198-B. Grants in lieu <strong>of</strong> jute export duty. - Until the abolition <strong>of</strong> the export duty levied by the<br />

Federation on jute or jute products or the expiration <strong>of</strong> ten years from the commencement <strong>of</strong> this<br />

Constitution, whichever is earlier, there shall be charged on the revenues <strong>of</strong> the Federation in each year<br />

as grants-in-aid <strong>of</strong> the revenues <strong>of</strong> the Provinces mentioned below the sums respectively specified<br />

against those Provinces:<br />

Province Sum<br />

West Bengal 100 lakhs <strong>of</strong> rupees.<br />

Bihar 17 lakhs <strong>of</strong> rupees.<br />

Assam 15 lakhs <strong>of</strong> rupees.<br />

Orissa 3 lakhs <strong>of</strong> rupees.<br />

199. Grants from Federation to certain units. - Such sums as the President may, on the<br />

recommendation <strong>of</strong> the Finance Commission, by order fix shall be charged on the revenues <strong>of</strong> the<br />

Federation in each year as grants-in-aid <strong>of</strong> the revenues <strong>of</strong> such units as the President may on such<br />

recommendation determine to be in need <strong>of</strong> assistance, and different sums may be fixed for different<br />

units:<br />

Provided that there shall be charged on the revenues <strong>of</strong> the Federation in each year as grants-in-aid<br />

<strong>of</strong> the revenues <strong>of</strong> the provinces <strong>of</strong> Assam and Orison the sums <strong>of</strong> thirty and forty lakhs <strong>of</strong> rupees<br />

respectively or such higher sums as the president may on the recommendation <strong>of</strong> the Finance<br />

commission fix in respect <strong>of</strong> either <strong>of</strong> these Provinces:<br />

Provided further that there shall be paid out <strong>of</strong> the revenues <strong>of</strong> the Federation as grants-in-aid <strong>of</strong> the<br />

revenues <strong>of</strong> a Province such capital and recurring sums as may be necessary to enable that Province to

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)