constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

constituent assembly of india debates (proceedings)- volume vii

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

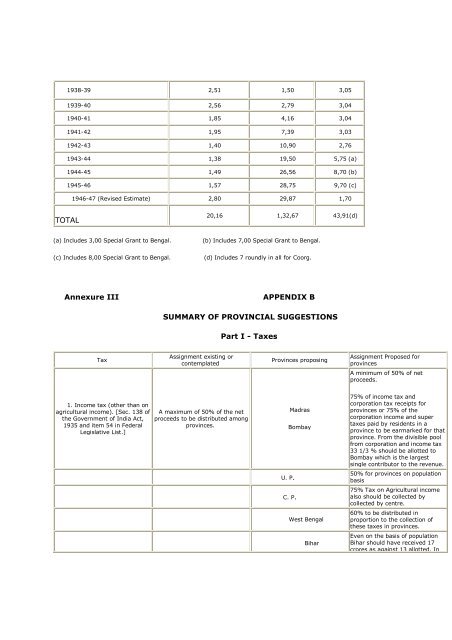

1938-39 2,51 1,50 3,05<br />

1939-40 2,56 2,79 3,04<br />

1940-41 1,85 4,16 3,04<br />

1941-42 1,95 7,39 3,03<br />

1942-43 1,40 10,90 2,76<br />

1943-44 1,38 19,50 5,75 (a)<br />

1944-45 1,49 26,56 8,70 (b)<br />

1945-46 1,57 28,75 9,70 (c)<br />

TOTAL<br />

1946-47 (Revised Estimate) 2,80 29,87 1,70<br />

20,16 1,32,67 43,91(d)<br />

(a) Includes 3,00 Special Grant to Bengal. (b) Includes 7,00 Special Grant to Bengal.<br />

(c) Includes 8,00 Special Grant to Bengal. (d) Includes 7 roundly in all for Coorg.<br />

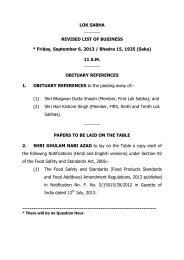

Annexure III APPENDIX B<br />

Tax<br />

1. Income tax (other than on<br />

agricultural income). [Sec. 138 <strong>of</strong><br />

the Government <strong>of</strong> India Act,<br />

1935 and item 54 in Federal<br />

Legislative List.]<br />

SUMMARY OF PROVINCIAL SUGGESTIONS<br />

Assignment existing or<br />

contemplated<br />

Part I - Taxes<br />

A maximum <strong>of</strong> 50% <strong>of</strong> the net<br />

proceeds to be distributed among<br />

provinces.<br />

Provinces proposing<br />

U. P.<br />

Madras<br />

Bombay<br />

C. P.<br />

West Bengal<br />

Bihar<br />

Assignment Proposed for<br />

provinces<br />

A minimum <strong>of</strong> 50% <strong>of</strong> net<br />

proceeds.<br />

75% <strong>of</strong> income tax and<br />

corporation tax receipts for<br />

provinces or 75% <strong>of</strong> the<br />

corporation income and super<br />

taxes paid by residents in a<br />

province to be earmarked for that<br />

province. From the divisible pool<br />

from corporation and income tax<br />

33 1/3 % should be allotted to<br />

Bombay which is the largest<br />

single contributor to the revenue.<br />

50% for provinces on population<br />

basis<br />

75% Tax on Agricultural income<br />

also should be collected by<br />

collected by centre.<br />

60% to be distributed in<br />

proportion to the collection <strong>of</strong><br />

these taxes in provinces.<br />

Even on the basis <strong>of</strong> population<br />

Bihar should have received 17<br />

crores as against 13 allotted. In

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/1/190x245/geeo-aeo-xeexee.jpg?quality=85)