TlB Annual Report 2009 - Triodos Bank

TlB Annual Report 2009 - Triodos Bank

TlB Annual Report 2009 - Triodos Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2009</strong> 2008<br />

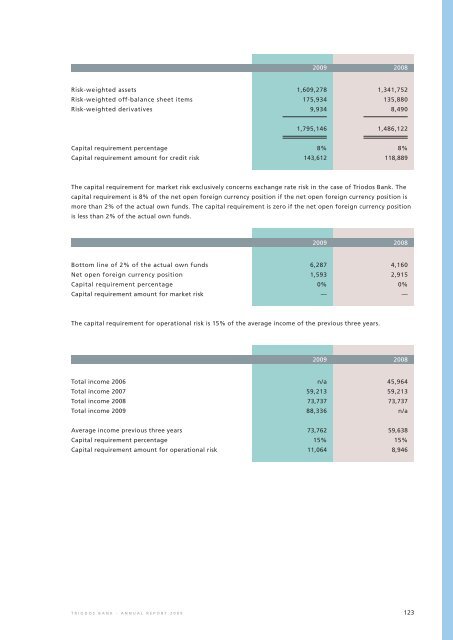

Risk-weighted assets 1,609,278 1,341,752<br />

Risk-weighted off-balance sheet items 175,934 135,880<br />

Risk-weighted derivatives 9,934 8,490<br />

1,795,146 1,486,122<br />

Capital requirement percentage 8% 8%<br />

Capital requirement amount for credit risk 143,612 118,889<br />

The capital requirement for market risk exclusively concerns exchange rate risk in the case of <strong>Triodos</strong> <strong>Bank</strong>. The<br />

capital requirement is 8% of the net open foreign currency position if the net open foreign currency position is<br />

more than 2% of the actual own funds. The capital requirement is zero if the net open foreign currency position<br />

is less than 2% of the actual own funds.<br />

<strong>2009</strong> 2008<br />

Bottom line of 2% of the actual own funds 6,287 4,160<br />

Net open foreign currency position 1,593 2,915<br />

Capital requirement percentage 0% 0%<br />

Capital requirement amount for market risk — —<br />

The capital requirement for operational risk is 15% of the average income of the previous three years.<br />

<strong>2009</strong> 2008<br />

Total income 2006 n/a 45,964<br />

Total income 2007 59,213 59,213<br />

Total income 2008 73,737 73,737<br />

Total income <strong>2009</strong> 88,336 n/a<br />

Average income previous three years 73,762 59,638<br />

Capital requirement percentage 15% 15%<br />

Capital requirement amount for operational risk 11,064 8,946<br />

TRIODOS BANK - ANNUAL REPORT <strong>2009</strong> 123