1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

21<br />

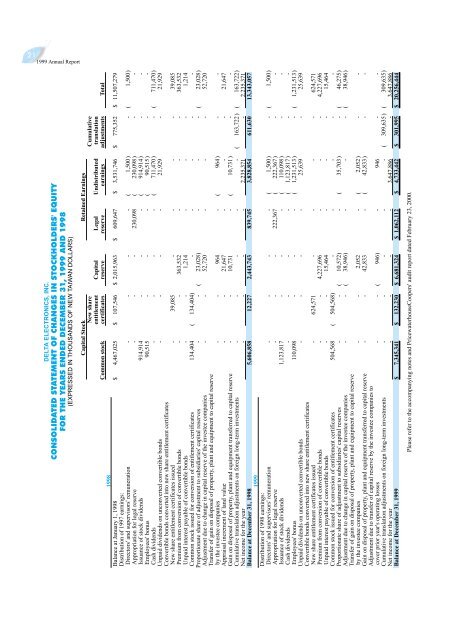

DELTA ELECTRONICS, INC.<br />

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY<br />

FOR THE YEARS ENDED DECEMBER 31, <strong>1999</strong> AND 1998<br />

(EXPRESSED IN THOUSANDS OF NEW TAIWAN DOLLARS)<br />

Capital Stock Retained Earnings<br />

New share Cumulative<br />

entitlement Capital Legal Undistributed translation<br />

Common stock certificates reserve reserve earnings adjustments Total<br />

1998<br />

Balance at January 1, 1998 $ 4,467,025 $ 107,546 $ 2,015,963 $ 609,647 $ 3,531,746 $ 775,352 $ 11,507,279<br />

Distribution of 1997 earnings:<br />

Directors' and supervisors' remuneration - - - - ( 1,500) - ( 1,500)<br />

Appropriation for legal reserve - - - 230,098 ( 230,098) - -<br />

Issuance of stock dividends 914,914 - - - ( 914,914) - -<br />

Employees' bonus 90,515 - - - ( 90,515) - -<br />

Cash dividends - - - - ( 711,470) - ( 711,470)<br />

Unpaid dividends on unconverted convertible bonds - - - - 21,929 - 21,929<br />

Convertible bonds converted into new share entitlement certificates<br />

New share entitlement certificates issued - 39,085 - - - - 39,085<br />

Premium from conversion of convertible bonds - - 363,532 - - - 363,532<br />

Unpaid interest payable of convertible bonds - - 1,214 - - - 1,214<br />

Common stock issued for conversion of entitlement certificates 134,404 ( 134,404) - - - - -<br />

Proportionate share of adjustment to subsidiaries' capital reserves - - ( 23,028) - - - ( 23,028)<br />

Adjustment due to change in capital reserve of the investee companies - - 52,720 - - - 52,720<br />

Transfer of gain on disposal of property, plant and equipment to capital reserve<br />

by the investee companies - - 964 - ( 964) - -<br />

Appraisal increment of land value - - 21,647 - - - 21,647<br />

Gain on disposal of property, plant and equipment transferred to capital reserve - - 10,731 - ( 10,731) - -<br />

Cumulative translation adjustments on foreign long-term investments - - - - - ( 163,722) ( 163,722)<br />

Net income for the year - - - - 2,235,371 - 2,235,371<br />

Balance at December 31, 1998 5,606,858 12,227 2,443,743 839,745 3,828,854 611,630 13,343,057<br />

<strong>1999</strong><br />

Distribution of 1998 earnings:<br />

Directors' and supervisors' remuneration - - - - ( 1,500) - ( 1,500)<br />

Appropriation for legal reserve - - - 222,367 ( 222,367) - -<br />

Issuance of stock dividends 1,123,817 - - - ( 110,098) - -<br />

Cash dividends - - - - ( 1,123,817) - -<br />

Employees' bonus 110,098 - - - ( 1,231,513) - ( 1,231,513)<br />

Unpaid dividends on unconverted convertible bonds - - - - 25,639 - 25,639<br />

Convertible bonds converted into new share entitlement certificates<br />

New share entitlement certificates issued - 624,571 - - - - 624,571<br />

Premium from conversion of convertible bonds - - 4,227,696 - - - 4,227,696<br />

Unpaid interest payable of convertible bonds - - 15,464 - - - 15,464<br />

Common stock issued for conversion of entitlement certificates 504,568 ( 504,568) - - - - -<br />

Proportionate share of adjustment to subsidiaries' capital reserves - - ( 10,572) - ( 35,703) - ( 46,275)<br />

Adjustment due to change in capital reserve of the investee companies - - ( 38,946) - - - ( 38,946)<br />

Transfer of gain on disposal of property, plant and equipment to capital reserve<br />

by the investee companies - - 2,052 - ( 2,052) - -<br />

Gain on disposal of property, plant and equipment transferred to capital reserve - - 42,833 - ( 42,833) - -<br />

Adjustment due to transfer of capital reserve by the investee companies to<br />

cover prior year's operating losses - - ( 946) - 946 - -<br />

Cumulative translation adjustments on foreign long-term investments - - - - - ( 309,635) ( 309,635)<br />

Net income for the year - - - - 3,647,886 - 3,647,886<br />

Balance at December 31, <strong>1999</strong> $ 7,345,341 $ 132,230 $ 6,681,324 $ 1,062,112 $ 4,733,442 $ 301,995 $ 20,256,444<br />

Please refer to the accompanying notes and PricewaterhouseCoopers' audit report dated February 23, 2000.