1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

37<br />

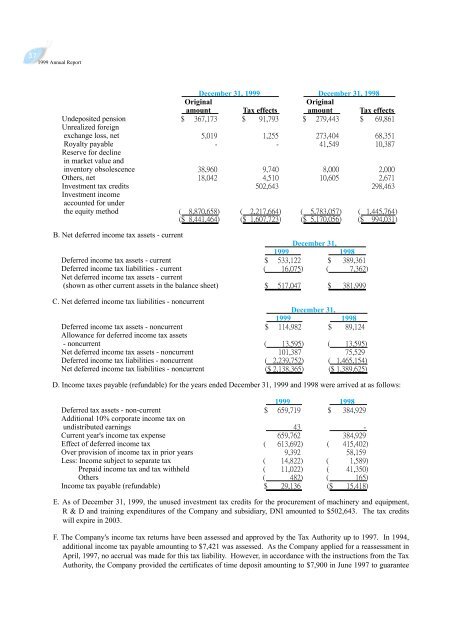

Undeposited pension<br />

Unrealized foreign<br />

exchange loss, net<br />

Royalty payable<br />

Reserve for decline<br />

in market value and<br />

inventory obsolescence<br />

Others, net<br />

Investment tax credits<br />

Investment income<br />

accounted for under<br />

the equity method<br />

B. Net deferred income tax assets - current<br />

Deferred income tax assets - current<br />

Deferred income tax liabilities - current<br />

Net deferred income tax assets - current<br />

(shown as other current assets in the balance sheet)<br />

C. Net deferred income tax liabilities - noncurrent<br />

Deferred income tax assets - noncurrent<br />

Allowance for deferred income tax assets<br />

- noncurrent<br />

Net deferred income tax assets - noncurrent<br />

Deferred income tax liabilities - noncurrent<br />

Net deferred income tax liabilities - noncurrent<br />

December 31, <strong>1999</strong> December 31, 1998<br />

Original Original<br />

amount Tax effects amount Tax effects<br />

D. Income taxes payable (refundable) for the years ended December 31, <strong>1999</strong> and 1998 were arrived at as follows:<br />

Deferred tax assets - non-current<br />

Additional 10% corporate income tax on<br />

undistributed earnings<br />

Current year's income tax expense<br />

Effect of deferred income tax<br />

Over provision of income tax in prior years<br />

Less: Income subject to separate tax<br />

Prepaid income tax and tax withheld<br />

Others<br />

Income tax payable (refundable)<br />

December 31,<br />

<strong>1999</strong> 1998<br />

December 31,<br />

<strong>1999</strong> 1998<br />

<strong>1999</strong> 1998<br />

E. As of December 31, <strong>1999</strong>, the unused investment tax credits for the procurement of machinery and equipment,<br />

R & D and training expenditures of the Company and subsidiary, DNI amounted to $502,643. The tax credits<br />

will expire in 2003.<br />

F. The Company's income tax returns have been assessed and approved by the Tax Authority up to 1997. In 1994,<br />

additional income tax payable amounting to $7,421 was assessed. As the Company applied for a reassessment in<br />

April, 1997, no accrual was made for this tax liability. However, in accordance with the instructions from the Tax<br />

Authority, the Company provided the certificates of time deposit amounting to $7,900 in June 1997 to guarantee