1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The initial conversion price, which was set on the issuance date at $86 (dollars) per share, is adjusted for<br />

increase in common shares outstanding. As of December 31, <strong>1999</strong>, the adjusted conversion price was $71.6<br />

(dollars) per share.<br />

The investors may require the Company to redeem the bonds for cash at 114.85% of the bond principal<br />

amount as of February 23, 2002 or 129.39% of the bond principal amount as of February 23, 2004.<br />

B) The difference between the redemption price and the par value of bonds, recognized as interest expense and<br />

Interest Payable on Redemption, using the effective interest method in <strong>1999</strong> was $57,992.<br />

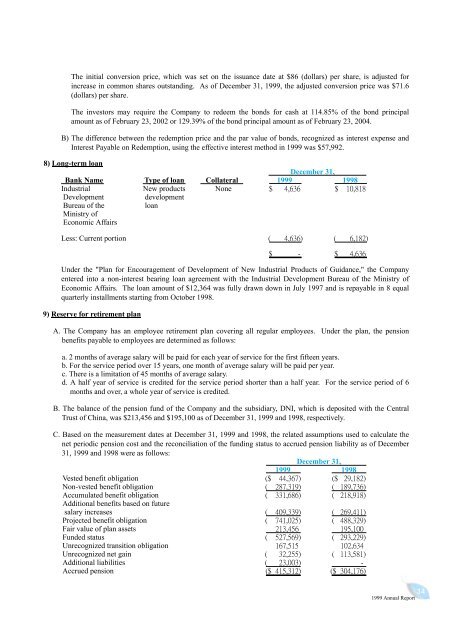

8)<br />

Long-term loan<br />

Bank Name Type of loan Collateral<br />

Industrial New products None<br />

Development development<br />

Bureau of the<br />

Ministry of<br />

Economic Affairs<br />

loan<br />

Less: Current portion<br />

Under the "Plan for Encouragement of Development of New Industrial Products of Guidance," the Company<br />

entered into a non-interest bearing loan agreement with the Industrial Development Bureau of the Ministry of<br />

Economic Affairs. The loan amount of $12,364 was fully drawn down in July 1997 and is repayable in 8 equal<br />

quarterly installments starting from October 1998.<br />

9) Reserve for retirement plan<br />

A. The Company has an employee retirement plan covering all regular employees. Under the plan, the pension<br />

benefits payable to employees are determined as follows:<br />

a. 2 months of average salary will be paid for each year of service for the first fifteen years.<br />

b. For the service period over 15 years, one month of average salary will be paid per year.<br />

c. There is a limitation of 45 months of average salary.<br />

d. A half year of service is credited for the service period shorter than a half year. For the service period of 6<br />

months and over, a whole year of service is credited.<br />

B. The balance of the pension fund of the Company and the subsidiary, DNI, which is deposited with the Central<br />

Trust of China, was $213,456 and $195,100 as of December 31, <strong>1999</strong> and 1998, respectively.<br />

C. Based on the measurement dates at December 31, <strong>1999</strong> and 1998, the related assumptions used to calculate the<br />

net periodic pension cost and the reconciliation of the funding status to accrued pension liability as of December<br />

31, <strong>1999</strong> and 1998 were as follows:<br />

Vested benefit obligation<br />

Non-vested benefit obligation<br />

Accumulated benefit obligation<br />

Additional benefits based on future<br />

salary increases<br />

Projected benefit obligation<br />

Fair value of plan assets<br />

Funded status<br />

Unrecognized transition obligation<br />

Unrecognized net gain<br />

Additional liabilities<br />

Accrued pension<br />

December 31,<br />

<strong>1999</strong> 1998<br />

December 31,<br />

<strong>1999</strong> 1998<br />

34