1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

13) Legal reserve<br />

The R.O.C Company Law requires that the Company shall set aside 10% of its net income as the legal reserve after<br />

covering prior years' losses until the legal reserve equals the capital stock balance. The legal reserve can be used<br />

only to cover an accumulated deficit or increase capital. The legal reserve can be used to increase capital only when<br />

the reserve exceeds 50% of capital stock, and should be limited to 50% of the excess portion of the reserve.<br />

14) Undistributed earnings<br />

A. Based on the Company's Articles of Incorporation, as revised in the shareholders' meeting on May 15, 1998, the<br />

current year's earnings, if any, shall be distributed in the following order:<br />

a) Payment of all taxes and dues.<br />

b) Cover prior years' operating losses, if any.<br />

c) After deducting (a) and (b), set aside 10% of the remaining amount as legal reserve.<br />

d) After deducting items (a), (b) and (c), allocate up to 1% of the remaining amount as directors' and supervisors'<br />

remuneration.<br />

e) After deducting items (a), (b) and (c), allocate at least 3% of the remaining amount as employees' bonus.<br />

f) After deducting items (a), (b), (c), (d) and (e), distribute the remaining amount as dividends and shareholders'<br />

bonus or keep as retained earnings according to the resolution of the meeting of stockholders.<br />

B. The new Taiwan imputation tax system requires that any undistributed current earnings, on tax basis, of a<br />

company derived on or after January 1, 1998 be subject to an additional 10% corporate income tax if the earnings<br />

are not distributed before a specific time. This 10% additional tax on undistributed earnings paid by the company<br />

can be used as tax credit by the shareholders, including foreign shareholders, against the withholding tax on<br />

dividends. In addition, the domestic shareholders can claim a proportionate share in the company's corporate<br />

income tax as tax credit against its individual income tax liability effective 1998.<br />

As of December 31, <strong>1999</strong>, the undistributed current earnings in 1998 of the subsidiary, DNI is subject to an<br />

additional 10% corporate tax amounting to $43.<br />

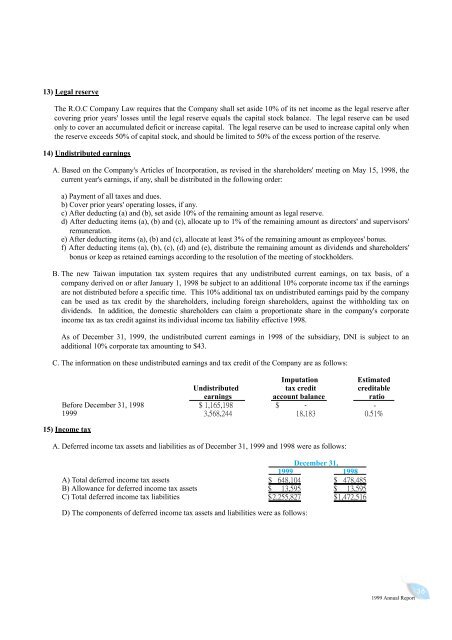

C. The information on these undistributed earnings and tax credit of the Company are as follows:<br />

Before December 31, 1998<br />

<strong>1999</strong><br />

15) Income tax<br />

Imputation Estimated<br />

Undistributed tax credit creditable<br />

earnings account balance ratio<br />

A. Deferred income tax assets and liabilities as of December 31, <strong>1999</strong> and 1998 were as follows:<br />

A) Total deferred income tax assets<br />

B) Allowance for deferred income tax assets<br />

C) Total deferred income tax liabilities<br />

D) The components of deferred income tax assets and liabilities were as follows:<br />

December 31,<br />

<strong>1999</strong> 1998<br />

36