1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

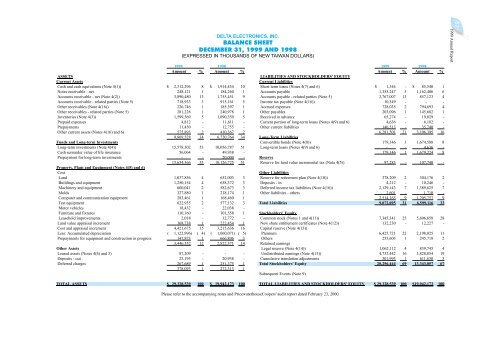

DELTA ELECTRONICS, INC.<br />

BALANCE SHEET<br />

DECEMBER 31, <strong>1999</strong> AND 1998<br />

(EXPRESSED IN THOUSANDS OF NEW TAIWAN DOLLARS)<br />

<strong>1999</strong> 1998 <strong>1999</strong> 1998<br />

Amount % Amount % Amount % Amount %<br />

ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY<br />

Current Assets Current Liabilities<br />

Cash and cash equivalents (Note 4(1)) $ 2,312,296 8 $ 1,914,434 10 Short-term loans (Notes 4(7) and 6) $ 1,344 - $ 85,540 1<br />

Notes receivable - net 248,121 1 184,260 1 Accounts payable 1,355,247 5 1,162,406 6<br />

Accounts receivable - net (Note 4(2)) 3,890,480 13 1,755,451 9 Accounts payable - related parties (Note 5) 3,767,007 13 857,123 4<br />

Accounts receivable - related parties (Note 5) 718,933 3 915,161 5 Income tax payable (Note 4(16)) 10,349 - - -<br />

Other receivables (Note 4(16)) 226,746 1 185,397 1 Accrued expenses 728,035 2 794,693 4<br />

Other receivables - related parties (Note 5) 281,228 1 240,978 1 Other payables 203,096 1 145,682 1<br />

Inventories (Note 4(3)) 1,599,569 5 1,090,350 5 Received in advance 65,274 - 19,029 -<br />

Prepaid expenses 4,812 - 11,611 - Current portion of long-term loans (Notes 4(9) and 6) 4,636 - 6,182 -<br />

Prepayments 11,450 - 12,755 - Other current liabilities 146,513 - 35,740 -<br />

Other current assets (Notes 4(16) and 6) 575,893 2 410,367 2 6,281,501 21 3,106,395 16<br />

9,869,528 34 6,720,764 34 Long-Term Liabilities<br />

Funds and Long-term Investments<br />

Convertible bonds (Note 4(8)) 179,146 1 1,674,588 8<br />

Long-term investments (Note 4(4)) 15,578,302 53 10,056,787 51 Long-term loans (Notes 4(9) and 6) - - 4,636 -<br />

Cash surrender value of life insurance 56,064 - 49,938 - 179,146 1 1,679,224 8<br />

Prepayment for long-term investments - - 20,000 - Reserve<br />

Property, Plant and Equipment (Notes 4(5) and 6)<br />

15,634,366 53 10,126,725 51 Reserve for land value incremental tax (Note 4(5)) 97,283 - 107,740 -<br />

Cost<br />

Other Liabilities<br />

Land 1,037,856 4 652,003 3 Reserve for retirement plan (Note 4(10)) 378,209 2 304,176 2<br />

Buildings and equipment 1,250,154 4 658,372 3 Deposits - in 4,212 - 10,246 -<br />

Machinery and equipment 600,041 2 582,673 3 Deferred income tax liabilities (Note 4(16)) 2,129,143 7 1,389,625 7<br />

Molds 327,880 1 218,174 1 Other liabilities - others 2,601 - 1,710 -<br />

Computer and communication equipment 283,461 1 168,460 1 2,514,165 9 1,705,757 9<br />

Test equipment 622,935 2 577,132 3 Total Liabilities 9,072,095 31 6,599,116 33<br />

Motor vehicles 18,432 - 22,038 -<br />

Furniture and fixtures 110,160 - 101,558 1 Stockholders' Equity<br />

Leasehold improvements 2,018 - 12,772 - Common stock (Notes 1 and 4(11)) 7,345,341 25 5,606,858 28<br />

Land value appraisal increment 168,738 1 222,454 1 New share entitlement certificates (Note 4(12)) 132,230 - 12,227 -<br />

Cost and appraisal increment 4,421,675 15 3,215,636 16 Capital reserve (Note 4(13))<br />

Less: Accumulated depreciation ( 1,122,996) ( 4) ( 1,060,071) ( 5) Premium 6,425,721 22 2,198,025 11<br />

Prepayments for equipment and construction in progress 147,873 1 666,806 3 Others 255,603 1 245,718 2<br />

3,446,552 12 2,822,371 14 Retained earnings<br />

Other Assets<br />

Legal reserve (Note 4(14)) 1,062,112 4 839,745 4<br />

Leased assets (Notes 4(6) and 5) 87,209 - - - Undistributed earnings (Note 4(15)) 4,733,442 16 3,828,854 19<br />

Deposits - out 23,195 - 20,938 - Cumulative translation adjustments 301,995 1 611,630 3<br />

Deferred charges 267,689 1 251,375 1 Total Stockholders' Equity 20,256,444 69 13,343,057 67<br />

378,093 1 272,313 1<br />

Subsequent Events (Note 9)<br />

TOTAL ASSETS $ 29,328,539 100 $ 19,942,173 100 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 29,328,539 100 $19,942,173 100<br />

Please refer to the accompanying notes and PricewaterhouseCoopers' audit report dated February 23, 2000.<br />

57