1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

35<br />

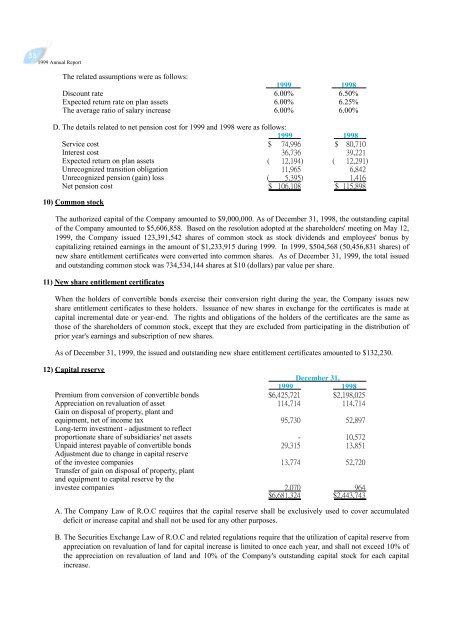

The related assumptions were as follows:<br />

<strong>1999</strong> 1998<br />

Discount rate 6.00% 6.50%<br />

Expected return rate on plan assets 6.00% 6.25%<br />

The average ratio of salary increase 6.00% 6.00%<br />

D. The details related to net pension cost for <strong>1999</strong> and 1998 were as follows:<br />

<strong>1999</strong> 1998<br />

Service cost<br />

Interest cost<br />

Expected return on plan assets<br />

Unrecognized transition obligation<br />

Unrecognized pension (gain) loss<br />

Net pension cost<br />

10) Common stock<br />

The authorized capital of the Company amounted to $9,000,000. As of December 31, 1998, the outstanding capital<br />

of the Company amounted to $5,606,858. Based on the resolution adopted at the shareholders' meeting on May 12,<br />

<strong>1999</strong>, the Company issued 123,391,542 shares of common stock as stock dividends and employees' bonus by<br />

capitalizing retained earnings in the amount of $1,233,915 during <strong>1999</strong>. In <strong>1999</strong>, $504,568 (50,456,831 shares) of<br />

new share entitlement certificates were converted into common shares. As of December 31, <strong>1999</strong>, the total issued<br />

and outstanding common stock was 734,534,144 shares at $10 (dollars) par value per share.<br />

11) New share entitlement certificates<br />

When the holders of convertible bonds exercise their conversion right during the year, the Company issues new<br />

share entitlement certificates to these holders. Issuance of new shares in exchange for the certificates is made at<br />

capital incremental date or year-end. The rights and obligations of the holders of the certificates are the same as<br />

those of the shareholders of common stock, except that they are excluded from participating in the distribution of<br />

prior year's earnings and subscription of new shares.<br />

As of December 31, <strong>1999</strong>, the issued and outstanding new share entitlement certificates amounted to $132,230.<br />

12) Capital reserve<br />

Premium from conversion of convertible bonds<br />

Appreciation on revaluation of asset<br />

Gain on disposal of property, plant and<br />

equipment, net of income tax<br />

Long-term investment - adjustment to reflect<br />

proportionate share of subsidiaries' net assets<br />

Unpaid interest payable of convertible bonds<br />

Adjustment due to change in capital reserve<br />

of the investee companies<br />

Transfer of gain on disposal of property, plant<br />

and equipment to capital reserve by the<br />

investee companies<br />

December 31,<br />

<strong>1999</strong> 1998<br />

A. The Company Law of R.O.C requires that the capital reserve shall be exclusively used to cover accumulated<br />

deficit or increase capital and shall not be used for any other purposes.<br />

B. The Securities Exchange Law of R.O.C and related regulations require that the utilization of capital reserve from<br />

appreciation on revaluation of land for capital increase is limited to once each year, and shall not exceed 10% of<br />

the appreciation on revaluation of land and 10% of the Company's outstanding capital stock for each capital<br />

increase.