1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

43<br />

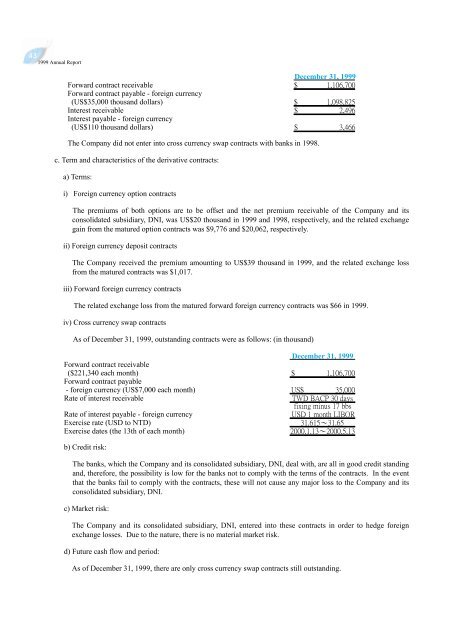

Forward contract receivable<br />

Forward contract payable - foreign currency<br />

(US$35,000 thousand dollars)<br />

Interest receivable<br />

Interest payable - foreign currency<br />

(US$110 thousand dollars)<br />

The Company did not enter into cross currency swap contracts with banks in 1998.<br />

c. Term and characteristics of the derivative contracts:<br />

a) Terms:<br />

i) Foreign currency option contracts<br />

The premiums of both options are to be offset and the net premium receivable of the Company and its<br />

consolidated subsidiary, DNI, was US$20 thousand in <strong>1999</strong> and 1998, respectively, and the related exchange<br />

gain from the matured option contracts was $9,776 and $20,062, respectively.<br />

ii) Foreign currency deposit contracts<br />

The Company received the premium amounting to US$39 thousand in <strong>1999</strong>, and the related exchange loss<br />

from the matured contracts was $1,017.<br />

iii) Forward foreign currency contracts<br />

The related exchange loss from the matured forward foreign currency contracts was $66 in <strong>1999</strong>.<br />

iv) Cross currency swap contracts<br />

As of December 31, <strong>1999</strong>, outstanding contracts were as follows: (in thousand)<br />

Forward contract receivable<br />

($221,340 each month)<br />

Forward contract payable<br />

- foreign currency (US$7,000 each month)<br />

Rate of interest receivable<br />

Rate of interest payable - foreign currency<br />

Exercise rate (USD to NTD)<br />

Exercise dates (the 13th of each month)<br />

b) Credit risk:<br />

The banks, which the Company and its consolidated subsidiary, DNI, deal with, are all in good credit standing<br />

and, therefore, the possibility is low for the banks not to comply with the terms of the contracts. In the event<br />

that the banks fail to comply with the contracts, these will not cause any major loss to the Company and its<br />

consolidated subsidiary, DNI.<br />

c) Market risk:<br />

The Company and its consolidated subsidiary, DNI, entered into these contracts in order to hedge foreign<br />

exchange losses. Due to the nature, there is no material market risk.<br />

d) Future cash flow and period:<br />

December 31, <strong>1999</strong><br />

December 31, <strong>1999</strong><br />

As of December 31, <strong>1999</strong>, there are only cross currency swap contracts still outstanding.