1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

short-term loan, accounts payable, tax payable, accrued expenses, other payables and other current liabilities are<br />

their fair values because of their short-term maturities.<br />

b. The fair value of cash surrender value of life insurance is based on book value at balance sheet date.<br />

c. The fair values of deposits-out and deposits-in are based on book value, which are close to present value.<br />

d. The fair value of convertible bonds is based on book value at balance sheet date because of the recognition of<br />

interest payable on redemption, for the difference between the redemption price and the par value of bonds, and<br />

the translation into New Taiwan dollars at the rates of exchange prevailing at the balance sheet date.<br />

e. The fair value of long-term loans (including current portion) is based on book value, because there is no<br />

significant difference in the discounted value of future cash flows and the carrying amount of long-term loans.<br />

B. The fair values of long-term investments are their market values or the underlying equity in net assets and/or other<br />

financial information, if market value is not available.<br />

C. The fair value of reserve for retirement plan is the funded status based on the retirement actuarial report as of<br />

December 31, <strong>1999</strong>.<br />

3) Information on derivative transactions<br />

A. General information disclosure:<br />

a. Purpose:<br />

The Company and its consolidated subsidiary, DNI, entered into certain foreign currency option contracts,<br />

premium currency deposit, forward foreign currency contracts and cross currency swap contracts to hedge foreign<br />

exchange risks in foreign currency denominated accounts receivable.<br />

b. Par value, contract amount and notional principal amount: (in thousand)<br />

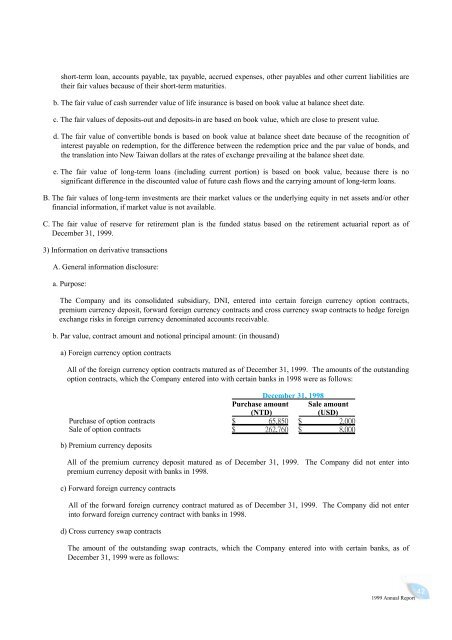

a) Foreign currency option contracts<br />

All of the foreign currency option contracts matured as of December 31, <strong>1999</strong>. The amounts of the outstanding<br />

option contracts, which the Company entered into with certain banks in 1998 were as follows:<br />

Purchase of option contracts<br />

Sale of option contracts<br />

b) Premium currency deposits<br />

All of the premium currency deposit matured as of December 31, <strong>1999</strong>. The Company did not enter into<br />

premium currency deposit with banks in 1998.<br />

c) Forward foreign currency contracts<br />

All of the forward foreign currency contract matured as of December 31, <strong>1999</strong>. The Company did not enter<br />

into forward foreign currency contract with banks in 1998.<br />

d) Cross currency swap contracts<br />

December 31, 1998<br />

Purchase amount Sale amount<br />

(NTD) (USD)<br />

The amount of the outstanding swap contracts, which the Company entered into with certain banks, as of<br />

December 31, <strong>1999</strong> were as follows:<br />

34 42