1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

33<br />

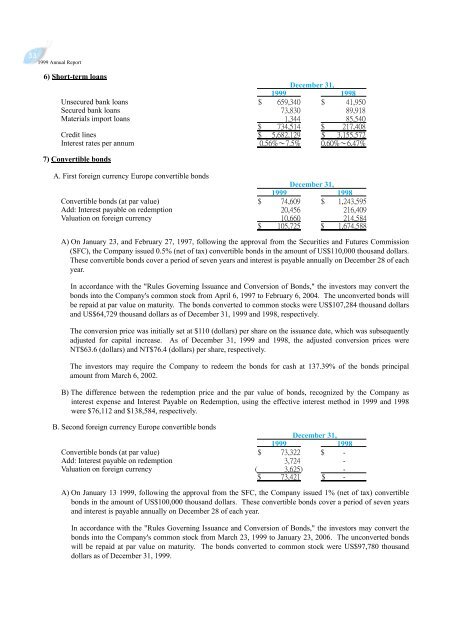

6) Short-term loans<br />

Unsecured bank loans<br />

Secured bank loans<br />

Materials import loans<br />

Credit lines<br />

Interest rates per annum<br />

7) Convertible bonds<br />

A. First foreign currency Europe convertible bonds<br />

Convertible bonds (at par value)<br />

Add: Interest payable on redemption<br />

Valuation on foreign currency<br />

A) On January 23, and February 27, 1997, following the approval from the Securities and Futures Commission<br />

(SFC), the Company issued 0.5% (net of tax) convertible bonds in the amount of US$110,000 thousand dollars.<br />

These convertible bonds cover a period of seven years and interest is payable annually on December 28 of each<br />

year.<br />

In accordance with the "Rules Governing Issuance and Conversion of Bonds," the investors may convert the<br />

bonds into the Company's common stock from April 6, 1997 to February 6, 2004. The unconverted bonds will<br />

be repaid at par value on maturity. The bonds converted to common stocks were US$107,284 thousand dollars<br />

and US$64,729 thousand dollars as of December 31, <strong>1999</strong> and 1998, respectively.<br />

The conversion price was initially set at $110 (dollars) per share on the issuance date, which was subsequently<br />

adjusted for capital increase. As of December 31, <strong>1999</strong> and 1998, the adjusted conversion prices were<br />

NT$63.6 (dollars) and NT$76.4 (dollars) per share, respectively.<br />

The investors may require the Company to redeem the bonds for cash at 137.39% of the bonds principal<br />

amount from March 6, 2002.<br />

B) The difference between the redemption price and the par value of bonds, recognized by the Company as<br />

interest expense and Interest Payable on Redemption, using the effective interest method in <strong>1999</strong> and 1998<br />

were $76,112 and $138,584, respectively.<br />

B. Second foreign currency Europe convertible bonds<br />

Convertible bonds (at par value)<br />

Add: Interest payable on redemption<br />

Valuation on foreign currency<br />

December 31,<br />

<strong>1999</strong> 1998<br />

December 31,<br />

<strong>1999</strong> 1998<br />

December 31,<br />

<strong>1999</strong> 1998<br />

A) On January 13 <strong>1999</strong>, following the approval from the SFC, the Company issued 1% (net of tax) convertible<br />

bonds in the amount of US$100,000 thousand dollars. These convertible bonds cover a period of seven years<br />

and interest is payable annually on December 28 of each year.<br />

In accordance with the "Rules Governing Issuance and Conversion of Bonds," the investors may convert the<br />

bonds into the Company's common stock from March 23, <strong>1999</strong> to January 23, 2006. The unconverted bonds<br />

will be repaid at par value on maturity. The bonds converted to common stock were US$97,780 thousand<br />

dollars as of December 31, <strong>1999</strong>.