1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

1999 Annual Report - Delta Electronics

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

41<br />

8. MAJOR CATASTROPHE<br />

No significant event has transpired which impacted the Company's and the consolidated subsidiary's operations.<br />

9. SUBSEQUENT EVENTS<br />

1) According to the resolution of the Company's Board of Directors on December 27, <strong>1999</strong>, the Company will issue<br />

foreign currency convertible bonds amounting to US$200 million. Following the approval from the SFC, the<br />

Company issued convertible bonds in the amount of US$200 million (received $6,142,400) on February 15, 2000.<br />

These convertible bonds have 0% interest and cover a period of five years.<br />

2) The Company invested in the new shares issued by Macronix International Co., Ltd. amounting to $92,684,<br />

representing 3,089,500 shares at NT$30 (dollars) per share. The transaction was ratified by the Company's Board<br />

of Directors on January 20, 2000. The Company's shareholding ratio changed from 3.04% to 2.99%.<br />

3) The Company invested $202,500 in the new shares issued by Grand Advance Technology Ltd. (GAT), representing<br />

8,100,000 shares at NT$25 (dollars) per share. The transaction was ratified by the Company's Board of Directors<br />

on February 19, 2000. As a result, the shareholding ratio in GAT decreased from 36% to 34.2%.<br />

4) The subsidiary of the Company, DIH, issued 4,500,000 new shares at US$8.73 (dollars) per share to increase its<br />

working capital and invest in <strong>Delta</strong> <strong>Electronics</strong> (Thailand) Public Co., Ltd. (DET). According to the resolution of<br />

the Company's Board of Directors on January 24, 2000, based on its current ownership percentage, the Company<br />

purchased DIH's 4,230,000 shares for US$36,928 thousand.<br />

After DIH's additional investment in DET in January, 2000, the Company's direct and indirect shareholding ratio in<br />

DET is above 20%. Commencing January 2000, the Company will recognize investment income or loss in DET<br />

under equity method and amortize the difference between cost and net assets<br />

5) On January 19, 2000, SFC approved the subsidiary's, DNI, application for public issuance of its stocks, and DNI<br />

accordingly, issued 30,000,000 new shares. On February 22, 2000, the Company invested $207,000, representing<br />

20,700,000 shares. The Company's shareholding ratio in DNI decreased from 99.99% to 86.71%.<br />

10. OTHERS<br />

1) The 1998 consolidated financial statements have been restated to reflect the consolidated reporting entities of DIH.<br />

Certain accounts in the 1998 consolidated financial statements have been reclassified to conform with the<br />

presentation adopted for <strong>1999</strong>.<br />

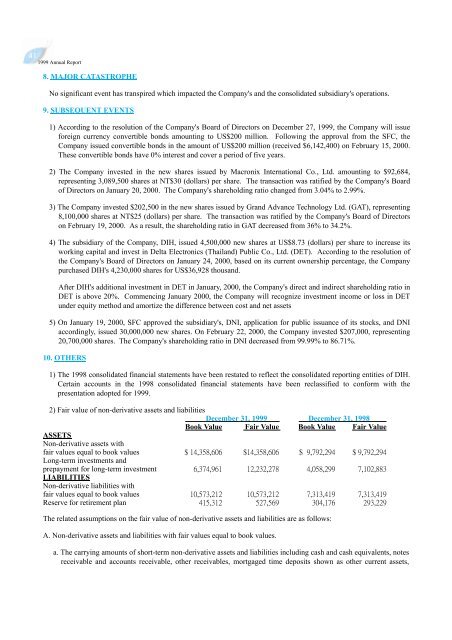

2) Fair value of non-derivative assets and liabilities<br />

December 31, <strong>1999</strong> December 31, 1998<br />

Book Value Fair Value Book Value Fair Value<br />

ASSETS<br />

Non-derivative assets with<br />

fair values equal to book values<br />

Long-term investments and<br />

prepayment for long-term investment<br />

LIABILITIES<br />

Non-derivative liabilities with<br />

fair values equal to book values<br />

Reserve for retirement plan<br />

The related assumptions on the fair value of non-derivative assets and liabilities are as follows:<br />

A. Non-derivative assets and liabilities with fair values equal to book values.<br />

a. The carrying amounts of short-term non-derivative assets and liabilities including cash and cash equivalents, notes<br />

receivable and accounts receivable, other receivables, mortgaged time deposits shown as other current assets,