Annual Report - JD Group

Annual Report - JD Group

Annual Report - JD Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

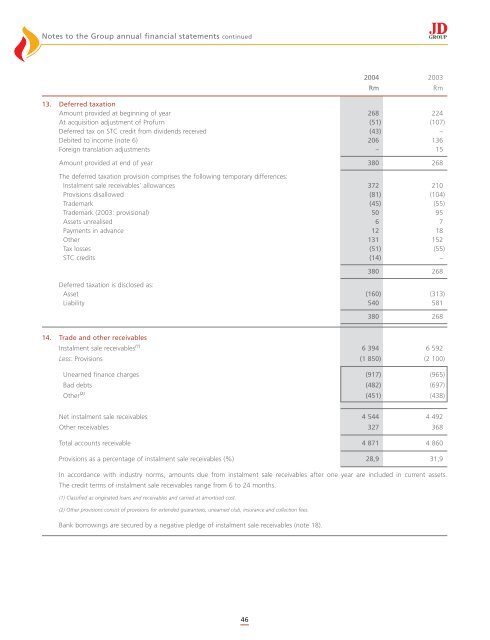

Notes to the <strong>Group</strong> annual financial statements continued<br />

46<br />

2004 2003<br />

Rm Rm<br />

13. Deferred taxation<br />

Amount provided at beginning of year 268 224<br />

At acquisition adjustment of Profurn (51) (107)<br />

Deferred tax on STC credit from dividends received (43) –<br />

Debited to income (note 6) 206 136<br />

Foreign translation adjustments – 15<br />

Amount provided at end of year 380 268<br />

The deferred taxation provision comprises the following temporary differences:<br />

Instalment sale receivables’ allowances 372 210<br />

Provisions disallowed (81) (104)<br />

Trademark (45) (55)<br />

Trademark (2003: provisional) 50 95<br />

Assets unrealised 6 7<br />

Payments in advance 12 18<br />

Other 131 152<br />

Tax losses (51) (55)<br />

STC credits (14) –<br />

380 268<br />

Deferred taxation is disclosed as:<br />

Asset (160) (313)<br />

Liability 540 581<br />

380 268<br />

14. Trade and other receivables<br />

Instalment sale receivables (1)<br />

6 394 6 592<br />

Less: Provisions (1 850) (2 100)<br />

Unearned finance charges (917) (965)<br />

Bad debts (482) (697)<br />

Other (2)<br />

(451) (438)<br />

Net instalment sale receivables 4 544 4 492<br />

Other receivables 327 368<br />

Total accounts receivable 4 871 4 860<br />

Provisions as a percentage of instalment sale receivables (%) 28,9 31,9<br />

In accordance with industry norms, amounts due from instalment sale receivables after one year are included in current assets.<br />

The credit terms of instalment sale receivables range from 6 to 24 months.<br />

(1) Classified as originated loans and receivables and carried at amortised cost.<br />

(2) Other provisions consist of provisions for extended guarantees, unearned club, insurance and collection fees.<br />

Bank borrowings are secured by a negative pledge of instalment sale receivables (note 18).