Annual Report - JD Group

Annual Report - JD Group

Annual Report - JD Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

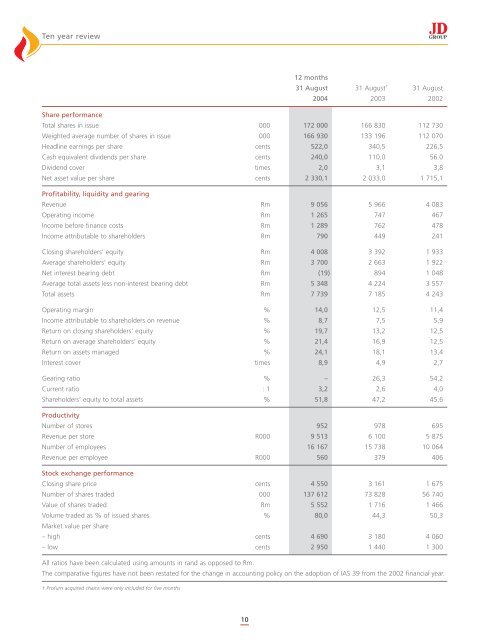

Ten year review<br />

10<br />

12 months<br />

31 August 31 August †<br />

31 August<br />

2004 2003 2002<br />

Share performance<br />

Total shares in issue 000 172 000 166 830 112 730<br />

Weighted average number of shares in issue 000 166 930 133 196 112 070<br />

Headline earnings per share cents 522,0 340,5 226,5<br />

Cash equivalent dividends per share cents 240,0 110,0 56.0<br />

Dividend cover times 2,0 3,1 3,8<br />

Net asset value per share cents 2 330,1 2 033,0 1 715,1<br />

Profitability, liquidity and gearing<br />

Revenue Rm 9 056 5 966 4 083<br />

Operating income Rm 1 265 747 467<br />

Income before finance costs Rm 1 289 762 478<br />

Income attributable to shareholders Rm 790 449 241<br />

Closing shareholders’ equity Rm 4 008 3 392 1 933<br />

Average shareholders’ equity Rm 3 700 2 663 1 922<br />

Net interest bearing debt Rm (19) 894 1 048<br />

Average total assets less non-interest bearing debt Rm 5 348 4 224 3 557<br />

Total assets Rm 7 739 7 185 4 243<br />

Operating margin % 14,0 12,5 11,4<br />

Income attributable to shareholders on revenue % 8,7 7,5 5,9<br />

Return on closing shareholders’ equity % 19,7 13,2 12,5<br />

Return on average shareholders’ equity % 21,4 16,9 12,5<br />

Return on assets managed % 24,1 18,1 13,4<br />

Interest cover times 8,9 4,9 2,7<br />

Gearing ratio % – 26,3 54,2<br />

Current ratio : 1 3,2 2,6 4,0<br />

Shareholders’ equity to total assets % 51,8 47,2 45,6<br />

Productivity<br />

Number of stores 952 978 695<br />

Revenue per store R000 9 513 6 100 5 875<br />

Number of employees 16 167 15 738 10 064<br />

Revenue per employee R000 560 379 406<br />

Stock exchange performance<br />

Closing share price cents 4 550 3 161 1 675<br />

Number of shares traded 000 137 612 73 828 56 740<br />

Value of shares traded Rm 5 552 1 716 1 466<br />

Volume traded as % of issued shares<br />

Market value per share<br />

% 80,0 44,3 50,3<br />

– high cents 4 690 3 180 4 060<br />

– low cents 2 950 1 440 1 300<br />

All ratios have been calculated using amounts in rand as opposed to Rm.<br />

The comparative figures have not been restated for the change in accounting policy on the adoption of IAS 39 from the 2002 financial year.<br />

† Profurn acquired chains were only included for five months