Annual Report - JD Group

Annual Report - JD Group

Annual Report - JD Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Group</strong> annual financial statements continued<br />

23. Employee benefit plans<br />

23.1 Retirement benefits<br />

The <strong>Group</strong> has made provision for pension and provident schemes covering substantially all employees. All eligible employees are<br />

members of either a defined benefit or a defined contribution scheme administered by Alexander Forbes Financial Services, Old Mutual<br />

Employee Benefits Industry Funds Unit or the Social Security Fund in Poland.<br />

One defined benefit scheme and 12 defined contribution schemes are in operation. The assets of these schemes are held in<br />

administered trust funds separated from the <strong>Group</strong>’s assets. Scheme assets primarily consist of listed shares, property trust units<br />

and fixed income securities. The schemes are governed by the South African Pension Funds Act of 1956 or the Polish Social Securities<br />

System Act of 1998.<br />

The defined benefit fund is valued actuarially at intervals of not more than three years using the projected unit credit method. The<br />

scheme was valued for financial reporting purposes at year end. The date of the next statutory actuarial valuation is 31 December 2004.<br />

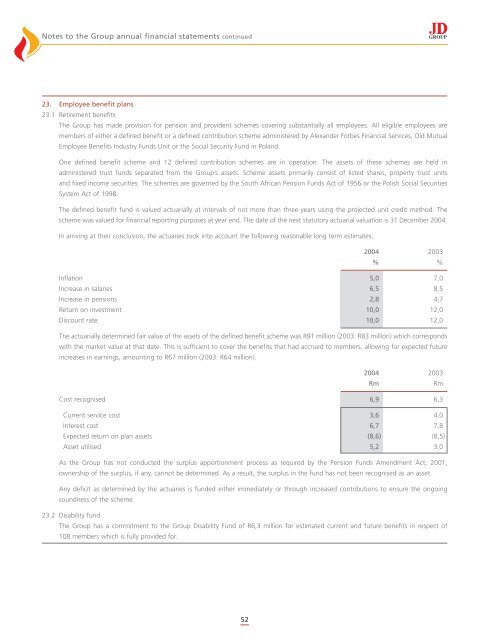

In arriving at their conclusion, the actuaries took into account the following reasonable long term estimates:<br />

52<br />

2004 2003<br />

% %<br />

Inflation 5,0 7,0<br />

Increase in salaries 6,5 8,5<br />

Increase in pensions 2,8 4,7<br />

Return on investment 10,0 12,0<br />

Discount rate 10,0 12,0<br />

The actuarially determined fair value of the assets of the defined benefit scheme was R91 million (2003: R83 million) which corresponds<br />

with the market value at that date. This is sufficient to cover the benefits that had accrued to members, allowing for expected future<br />

increases in earnings, amounting to R67 million (2003: R64 million).<br />

2004 2003<br />

Rm Rm<br />

Cost recognised 6,9 6,3<br />

Current service cost 3,6 4,0<br />

Interest cost 6,7 7,8<br />

Expected return on plan assets (8,6) (8,5)<br />

Asset utilised 5,2 3,0<br />

As the <strong>Group</strong> has not conducted the surplus apportionment process as required by the Pension Funds Amendment Act, 2001,<br />

ownership of the surplus, if any, cannot be determined. As a result, the surplus in the fund has not been recognised as an asset.<br />

Any deficit as determined by the actuaries is funded either immediately or through increased contributions to ensure the ongoing<br />

soundness of the scheme.<br />

23.2 Disability fund<br />

The <strong>Group</strong> has a commitment to the <strong>Group</strong> Disability Fund of R6,3 million for estimated current and future benefits in respect of<br />

108 members which is fully provided for.