Arani Town - Municipal

Arani Town - Municipal

Arani Town - Municipal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

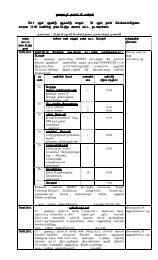

Chapter - 14 Final Report: <strong>Arani</strong> <strong>Municipal</strong>ity<br />

c) Power charges<br />

There will be a savings of around 40% in power charges due to installation of energy<br />

saving lights. As the same will be installed by private players, the savings in power<br />

charges have been factored in the financial projections after 15 years. It is<br />

assumed that the savings in power charges would be utilised towards returns of the<br />

private player towards capital cost and interest.<br />

d) Interest<br />

Interest on loan have been provided based on the sanction rate for each loan.<br />

Repayment of loans are based on the repayment schedule of each loan.<br />

Sewerage & Water Supply Loan<br />

It is assumed that all new loan shall carry interest rate of 9.5% per annum.<br />

The loan from TNUIFSL shall be repaid over a period of 20 years with 5 years<br />

moratorium.<br />

Other Projects Loan<br />

It is assumed that all new loan shall carry interest rate of 9.5% per annum.<br />

The loan from TNUIFSL shall be repaid over a period of 10 years with 2 years<br />

moratorium.<br />

e) Depreciation<br />

Depreciation is provided based on the rates adopted by the <strong>Municipal</strong>ity for<br />

previous years.<br />

f) Provision of doubtful debts<br />

Doubtful debts have been provided as under :<br />

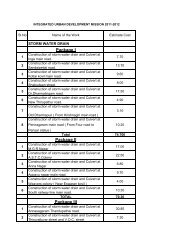

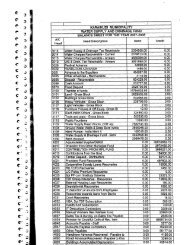

Table 14-15: Assumptions ñ Provision of doubtful debts<br />

Provision for Doubtful Debts is assumed @ 2% on total revenue for Revenue Fund<br />

Provision for Doubtful Debts is assumed @ 1% on total revenue for Water Fund<br />

Provision for Doubtful Debts is assumed @ 0% on total revenue for Education Fund<br />

14.5.3 Collections<br />

a) Property tax<br />

Table 14-16: Assumptions ñ Property tax collection<br />

The current property tax collection is 70% The same shall improve to 95%<br />

over the next 5 years.<br />

The arrears property tax collection is 30% The same shall improve to 60%<br />

over the next 5 years.<br />

b) Profession tax<br />

Table 14-17: Assumptions ñ Profession tax<br />

The current profession tax collection is 64% The same shall improve to 90%<br />

over the next 5 years.<br />

The arrears profession tax collection is 25% The same shall improve to 50%<br />

over the next 5 years.<br />

. - 120 -<br />

Voyants Solutions Private Limited