Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

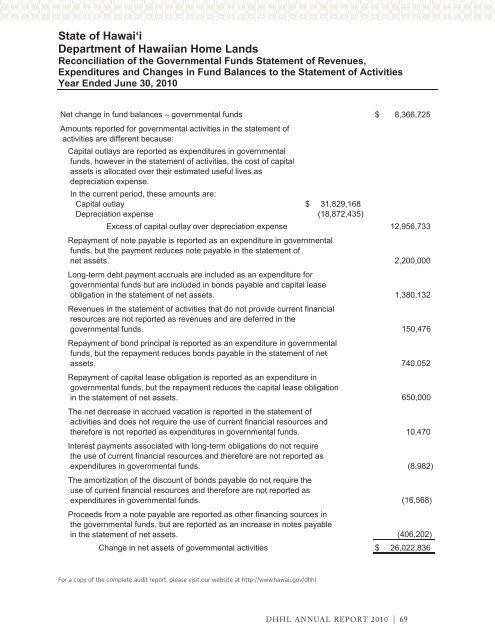

State of Hawai‘i<br />

Department of Hawaiian Home Lands<br />

Reconciliation of the Governmental Funds Statement of Revenues,<br />

Expenditures and Changes in Fund Balances to the Statement of Activities<br />

Year Ended June 30, 2010<br />

Net change in fund balances – governmental funds $ 8,366,725<br />

Amounts reported for governmental activities in the statement of<br />

activities are different because:<br />

Capital outlays are reported as expenditures in governmental<br />

funds, however in the statement of activities, the cost of capital<br />

assets is allocated over their esti<strong>ma</strong>ted useful lives as<br />

depreciation expense.<br />

In the current period, these amounts are:<br />

Capital outlay $ 31,829,168<br />

Depreciation expense (18,872,435)<br />

Excess of capital outlay over depreciation expense 12,956,733<br />

Repayment of note payable is reported as an expenditure in governmental<br />

funds, but the payment reduces note payable in the statement of<br />

net assets. 2,200,000<br />

Long-term debt payment accruals are included as an expenditure for<br />

governmental funds but are included in bonds payable and capital lease<br />

obligation in the statement of net assets. 1,380,132<br />

Revenues in the statement of activities that do not provide current financial<br />

resources are not reported as revenues and are deferred in the<br />

governmental funds. 150,476<br />

Repayment of bond principal is reported as an expenditure in governmental<br />

funds, but the repayment reduces bonds payable in the statement of net<br />

assets. 740,052<br />

Repayment of capital lease obligation is reported as an expenditure in<br />

governmental funds, but the repayment reduces the capital lease obligation<br />

in the statement of net assets. 650,000<br />

The net decrease in accrued vacation is reported in the statement of<br />

activities and does not require the use of current financial resources and<br />

therefore is not reported as expenditures in governmental funds. 10,470<br />

Interest payments associated with long-term obligations do not require<br />

the use of current financial resources and therefore are not reported as<br />

expenditures in governmental funds. (8,982)<br />

The amortization of the discount of bonds payable do not require the<br />

use of current financial resources and therefore are not reported as<br />

expenditures in governmental funds. (16,568)<br />

Proceeds from a note payable are reported as other financing sources in<br />

the governmental funds, but are reported as an increase in notes payable<br />

in the statement of net assets. (406,202)<br />

Change in net assets of governmental activities $ 26,022,836<br />

For a copy of the complete audit report, please visit our website at http://www.hawaii.gov/dhhl<br />

The accompanying notes are an integral part of the financial statements.<br />

16<br />

DHHL ANNUAL REPORT 2010 | 69