SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MARKET REPORTS<br />

Rates and fixtures week 19<br />

Shortsea dry bulk market report<br />

Baltic. The number of spot/prompt open<br />

ships throughout whole Baltic clearly indicates<br />

that the market has softened somewhat<br />

in regards to activity and momentum.<br />

Owners are still obtaining decent rates out<br />

of the Baltic to the Mediterranean and the<br />

Continent, but some destinations are<br />

down in region of EUR 1 p/mt in the<br />

3,000 mt size. 3,000 mt grains 45’ from<br />

German Baltic to ECUK has been fixed at<br />

EUR 15 this week compared to EUR<br />

16–16.50 a few weeks back. Still good<br />

demand in the scrap sector and ships in the<br />

4,000 DWT + are still very difficult to<br />

attract for this type of business.<br />

Activity level: Mixed<br />

Scandinavia. It has been a surprisingly<br />

quiet week with very limited re-let activity<br />

along the coast of <strong>No</strong>rway. Little agri-product<br />

movements combined with holidays<br />

and the Copenhagen Shipbrokers dinner<br />

naturally brought activity down especially<br />

in the latter part of the week. There have<br />

been an increasing number of spot units in<br />

the area this week with several ships<br />

remaining unfixed for up to two days.<br />

Owners have been trying to hold out for<br />

that relieving cargo, but in the end many<br />

decided to bite the dust and get their ship<br />

fixed ahead with mixed results.<br />

Activity level: Mixed<br />

UK/Continent. The UK/Continental market<br />

remains fairly active in all sectors, but<br />

the number of prompt positions is making<br />

brokers believe that the market has stabilized<br />

presently. Still a good deal of agriproduct<br />

movements from ARAG to the<br />

UK, Scandinavia and Baltic and brokers<br />

continue to struggle to cover their requirements<br />

without pushing rates higher.<br />

Charterers have been looking to fix<br />

1,500 mt soyameal 58’ from ARAG to Ire-<br />

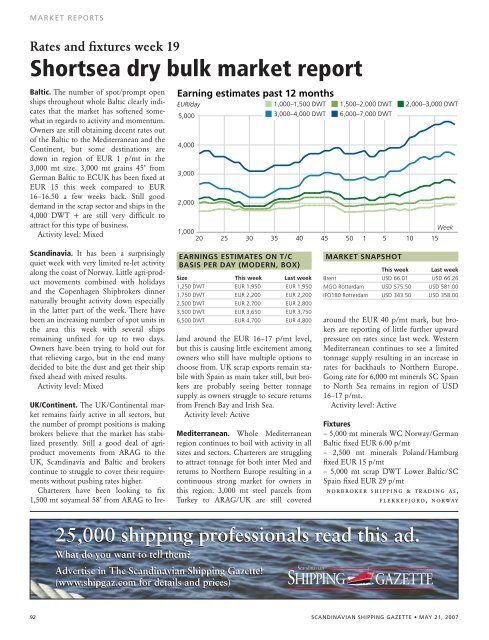

Earning estimates past 12 months<br />

EUR/day ■ 1,000–1,500 DWT ■ 1,500–2,000 DWT ■ 2,000–3,000 DWT<br />

■ 3,000–4,000 DWT ■ 6,000–7,000 DWT<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

20<br />

25<br />

EARNINGS ESTIMATES ON T/C<br />

BASIS PER DAY (MODERN, BOX)<br />

Size This week Last week<br />

1,250 DWT EUR 1,950 EUR 1,950<br />

1,750 DWT EUR 2,200 EUR 2,200<br />

2,500 DWT EUR 2,700 EUR 2,800<br />

3,500 DWT EUR 3,650 EUR 3,750<br />

6,500 DWT EUR 4,700 EUR 4,800<br />

land around the EUR 16–17 p/mt level,<br />

but this is causing little excitement among<br />

owners who still have multiple options to<br />

choose from. UK scrap exports remain stabile<br />

with Spain as main taker still, but brokers<br />

are probably seeing better tonnage<br />

supply as owners struggle to secure returns<br />

from French Bay and Irish Sea.<br />

Activity level: Active<br />

Mediterranean. Whole Mediterranean<br />

region continues to boil with activity in all<br />

sizes and sectors. Charterers are struggling<br />

to attract tonnage for both inter Med and<br />

returns to <strong>No</strong>rthern Europe resulting in a<br />

continuous strong market for owners in<br />

this region. 3,000 mt steel parcels from<br />

Turkey to ARAG/UK are still covered<br />

MARKET SNAPSHOT<br />

This week Last week<br />

Brent USD 66.01 USD 66.26<br />

MGO Rotterdam USD 575.50 USD 581.00<br />

IFO180 Rotterdam USD 343.50 USD 358.00<br />

around the EUR 40 p/mt mark, but brokers<br />

are reporting of little further upward<br />

pressure on rates since last week. Western<br />

Mediterranean continues to see a limited<br />

tonnage supply resulting in an increase in<br />

rates for backhauls to <strong>No</strong>rthern Europe.<br />

Going rate for 6,000 mt minerals SC Spain<br />

to <strong>No</strong>rth Sea remains in region of USD<br />

16–17 p/mt.<br />

Activity level: Active<br />

Fixtures<br />

– 5,000 mt minerals WC <strong>No</strong>rway/German<br />

Baltic fixed EUR 6.00 p/mt<br />

– 2,500 mt minerals Poland/Hamburg<br />

fixed EUR 15 p/mt<br />

– 5,000 mt scrap DWT Lower Baltic/SC<br />

Spain fixed EUR 29 p/mt<br />

norbroker shipping & trading as,<br />

flekkefjord, norway<br />

25,000 shipping professionals read this ad.<br />

What do you want to tell them?<br />

Advertise in The Scandinavian Shipping Gazette!<br />

(www.shipgaz.com for details and prices)<br />

92 SCANDINAVIAN SHIPPING GAZETTE • MAY 21, 2007<br />

30<br />

35<br />

40<br />

45<br />

50<br />

1<br />

5<br />

<strong>10</strong><br />

15<br />

Week