SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET REPORTS<br />

Tank – volatile markets continue<br />

❯<br />

<strong>No</strong>rth Europe remains a very volatile<br />

and unpredictable market for owners<br />

of crude loader. The tanker surplus, particularly<br />

of aframax and suezmax, is beginning<br />

to tell. Admittedly aframax freight<br />

firmed as we went to press, but there is little<br />

prospect f more than WS 160 – WS 170<br />

on the Primorsk and <strong>No</strong>rth Sea routes. The<br />

past four weeks have been particularly for<br />

owners of aframax tonnage.<br />

A brief look at the headlines of our<br />

weekly reports says it all. They read as follows:<br />

Week 16 – “Volatile for crude loaders”,<br />

week 17 – “Aframax/suezmax firmer”,<br />

week 18 – “Aframax down in patchy trading”<br />

and week 19 ended with firmer aframax<br />

freight in both the <strong>No</strong>rth Sea and the<br />

Baltic.<br />

In our last report we made the point that<br />

the order book for aframax tonnage of 29.6<br />

million dwt is bound to have an effect on<br />

the prospects. The bulk of the current aframax<br />

order book is for delivery in 2008 (8.6<br />

million dwt) and in 2009 (<strong>10</strong>.1 million<br />

dwt). The suezmax order book is slightly<br />

smaller. In any case, demand for suezmax<br />

tonnage in the <strong>No</strong>rth Sea and the Baltic is<br />

too patchy to influence the market.<br />

Medium Range (MR) clean tonnage<br />

breached the WS 300 mark in the past fortnight<br />

to end up around WS280 on the<br />

Trans-Atlantic (TA) westbound leg. Again<br />

the MR order book in excess of 19.0 mil-<br />

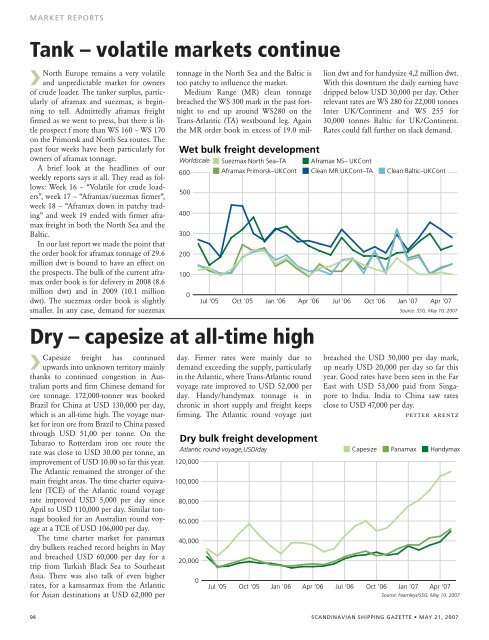

Wet bulk freight development<br />

Worldscale ■ Suezmax <strong>No</strong>rth Sea–TA ■ Aframax NS– UKCont<br />

600<br />

500<br />

400<br />

300<br />

200<br />

<strong>10</strong>0<br />

0<br />

Jul ’05<br />

Oct ’05<br />

lion dwt and for handysize 4,2 million dwt.<br />

With this downturn the daily earning have<br />

dripped below USD 30,000 per day. Other<br />

relevant rates are WS 280 for 22,000 tonnes<br />

Inter UK/Continent and WS 255 for<br />

30,000 tonnes Baltic for UK/Continent.<br />

Rates could fall further on slack demand.<br />

94 SCANDINAVIAN SHIPPING GAZETTE • MAY 21, 2007<br />

Jan ’06<br />

Apr ’06<br />

Dry – capesize at all-time high<br />

❯<br />

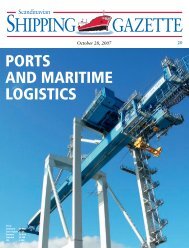

Capesize freight has continued<br />

upwards into unknown territory mainly<br />

thanks to continued congestion in Australian<br />

ports and firm Chinese demand for<br />

ore tonnage. 172,000-tonner was booked<br />

Brazil for China at USD 130,000 per day,<br />

which is an all-time high. The voyage market<br />

for iron ore from Brazil to China passed<br />

through USD 51,00 per tonne. On the<br />

Tubarao to Rotterdam iron ore route the<br />

rate was close to USD 30.00 per tonne, an<br />

improvement of USD <strong>10</strong>.00 so far this year.<br />

The Atlantic remained the stronger of the<br />

main freight areas. The time charter equivalent<br />

(TCE) of the Atlantic round voyage<br />

rate improved USD 5,000 per day since<br />

April to USD 1<strong>10</strong>,000 per day. Similar tonnage<br />

booked for an Australian round voyage<br />

at a TCE of USD <strong>10</strong>6,000 per day.<br />

The time charter market for panamax<br />

dry bulkers reached record heights in May<br />

and breached USD 60,000 per day for a<br />

trip from Turkish Black Sea to Southeast<br />

Asia. There was also talk of even higher<br />

rates, for a kamsarmax from the Atlantic<br />

for Asian destinations at USD 62,000 per<br />

■ Aframax Primorsk–UKCont ■ Clean MR UKCont–TA ■ Clean Baltic–UKCont<br />

day. Firmer rates were mainly due to<br />

demand exceeding the supply, particularly<br />

in the Atlantic, where Trans-Atlantic round<br />

voyage rate improved to USD 52,000 per<br />

day. Handy/handymax tonnage is in<br />

chronic in short supply and freight keeps<br />

firming. The Atlantic round voyage just<br />

120,000<br />

<strong>10</strong>0,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

Jul ’06<br />

Oct ’06<br />

Jan ’07<br />

Apr ’07<br />

Source: <strong>SSG</strong>, May <strong>10</strong>, 2007<br />

breached the USD 50,000 per day mark,<br />

up nearly USD 20,000 per day so far this<br />

year. Good rates have been seen in the Far<br />

East with USD 53,000 paid from Singapore<br />

to India. India to China saw rates<br />

close to USD 47,000 per day.<br />

petter arentz<br />

Dry bulk freight development<br />

Atlantic round voyage,USD/day ■ Capesize ■ Panamax ■ Handymax<br />

Jul ’05<br />

Oct ’05<br />

Jan ’06<br />

Apr ’06<br />

Jul ’06<br />

Oct ’06<br />

Jan ’07<br />

Apr '07<br />

Source: Fearnleys/<strong>SSG</strong>, May <strong>10</strong>, 2007