SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Offshore market report May<br />

❯<br />

The strong offshore market is keeping<br />

up its strength, with a dynamic spot<br />

market and ample opportunities for longterm<br />

business. So far, the 2007 rate level<br />

has been somewhat below last year’s, but<br />

the maritime offshore industry is keeping<br />

up faith in the market. This is reflected in<br />

the number of new orders; although much<br />

appears now to be driven by Indian and<br />

Far Eastern owners.<br />

Looking at the offshore service industry<br />

in a wider perspective, established and new<br />

contenders continue to raise large amounts<br />

of money, on projects from seismic data<br />

collection to heavylift vessels, crane ships,<br />

production vessels, drilling and accommodation<br />

units. <strong>No</strong>rwegian-related interests<br />

are said to be behind 58 of the 116 drilling<br />

vessels on order worldwide, with a total<br />

value of NOK <strong>10</strong>1.7 billion (USD 17 billion),<br />

according to the business daily<br />

“Dagens Næringsliv”.<br />

Far Eastern focus<br />

Several <strong>No</strong>rwegian supply ship owners have<br />

used the recent boom to extend their activities,<br />

in range as well as geography. Going<br />

from anchorhandlers and platform vessels<br />

into subsea support ships has enabled companies<br />

like Farstad, Rem Offshore and others<br />

to build a broader basis. A good number<br />

of these expensive ships have been fixed for<br />

longer periods in the Gulf of Mexico, West<br />

Africa and other places.<br />

Others are aiming for operations for Far<br />

Eastern waters. Solstad and <strong>No</strong>rtrans are<br />

joint owners of <strong>No</strong>r Offshore in Singapore,<br />

Havila in PACC-Havila with local partners<br />

and Farstad has been working from its Australian<br />

base for many years. PACC-Havila<br />

recently increased its newbuilding program<br />

in China from 6 to 8 smaller ahts.<br />

The recent tie-up between Aker and<br />

DOF in ordering 6+6 12,000 BHP<br />

anchorhandlers from Aker Yards’ new facility<br />

in Vietnam is a major step into the Far<br />

Eastern market.<br />

More contracts<br />

Bourbon Offshore <strong>No</strong>rway is building four<br />

PX<strong>10</strong>5-type platform vessels at Zhejiang in<br />

China for 2009/<strong>10</strong> delivery. Siem Offshore<br />

took another two MPSVs from Kleven for<br />

20<strong>10</strong>, making it a series of eight mighty<br />

28,000 BHP vessels at USD 90 apiece.<br />

REM Con, an affiliate of REM Offshore,<br />

has ordered two large units for deep-water<br />

construction with 500-ton winch and<br />

accommodation for 70 from Aker Brattvaag<br />

at USD 115 million each.<br />

The Faroese-based Pf Supply Service will<br />

take a second PSV for Havyards, subcontracted<br />

to Fjellstrand for end of 2008 delivery.<br />

Also Solvik Offshore, based in Austevoll,<br />

has declared its option for a second<br />

VS485 PSV from Hellesøy, for delivery in<br />

October 2008.<br />

The German <strong>No</strong>rdcapital Holding has<br />

140<br />

120<br />

<strong>10</strong>0<br />

80<br />

60<br />

40<br />

20<br />

0<br />

20<br />

MARKET REPORTS<br />

returned to Aker Yards for two platform vessels<br />

of the UT776CD design at USD 55 million<br />

each, for 2009/<strong>10</strong> delivery. This owner<br />

has already six smaller UT755Ls on order.<br />

As for the largest anchorhandlers so far,<br />

the two ordered by Lewek Shipping of Singapore<br />

from compatriot Pan United<br />

Marine must surely rank amongst the<br />

biggest, with engines of 30,000 BHP, of the<br />

UT788CD design. Delivery is set for the<br />

end of 2009 at USD 64 million each.<br />

dag bakka jr<br />

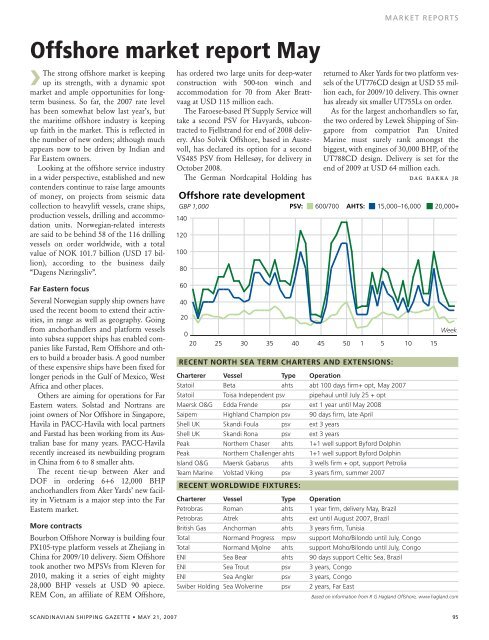

Offshore rate development<br />

GBP 1,000 PSV: ■ 600/700 AHTS: ■ 15,000–16,000 ■ 20,000+<br />

25<br />

30<br />

SCANDINAVIAN SHIPPING GAZETTE • MAY 21, 2007 95<br />

35<br />

RECENT NORTH SEA TERM CHARTERS AND EXTENSIONS:<br />

Charterer Vessel Type Operation<br />

Statoil Beta ahts abt <strong>10</strong>0 days firm+ opt, May 2007<br />

Statoil Toisa Independent psv pipehaul until July 25 + opt<br />

Maersk O&G Edda Frende psv ext 1 year until May 2008<br />

Saipem Highland Champion psv 90 days firm, late April<br />

Shell UK Skandi Foula psv ext 3 years<br />

Shell UK Skandi Rona psv ext 3 years<br />

Peak <strong>No</strong>rthern Chaser ahts 1+1 well support Byford Dolphin<br />

Peak <strong>No</strong>rthern Challenger ahts 1+1 well support Byford Dolphin<br />

Island O&G Maersk Gabarus ahts 3 wells firm + opt, support Petrolia<br />

Team Marine Volstad Viking psv 3 years firm, summer 2007<br />

40<br />

RECENT WORLDWIDE FIXTURES:<br />

Charterer Vessel Type Operation<br />

Petrobras Roman ahts 1 year firm, delivery May, Brazil<br />

Petrobras Atrek ahts ext until August 2007, Brazil<br />

British Gas Anchorman ahts 3 years firm, Tunisia<br />

Total <strong>No</strong>rmand Progress mpsv support Moho/Bilondo until July, Congo<br />

Total <strong>No</strong>rmand Mjolne ahts support Moho/Bilondo until July, Congo<br />

ENI Sea Bear ahts 90 days support Celtic Sea, Brazil<br />

ENI Sea Trout psv 3 years, Congo<br />

ENI Sea Angler psv 3 years, Congo<br />

Swiber Holding Sea Wolverine psv 2 years, Far East<br />

45<br />

50<br />

1<br />

5<br />

<strong>10</strong><br />

15<br />

Week<br />

Based on information from R G Hagland Offshore, www.hagland.com