Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

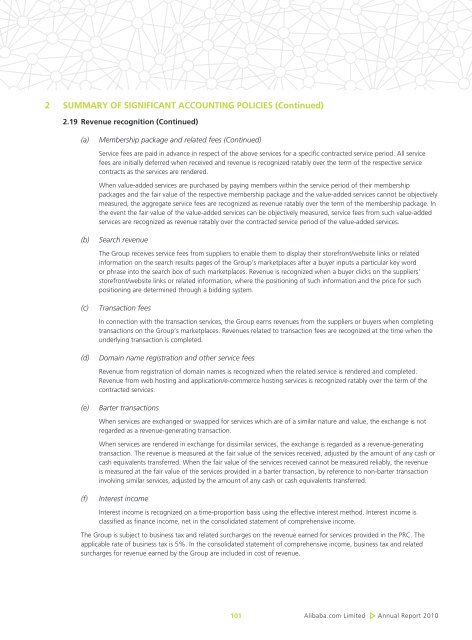

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

2.19 Revenue recognition (Continued)<br />

(a) Membership package and related fees (Continued)<br />

Service fees are paid in advance in respect of the above services for a specific contracted service period. All service<br />

fees are initially deferred when received and revenue is recognized ratably over the term of the respective service<br />

contracts as the services are rendered.<br />

When value-added services are purchased by paying members within the service period of their membership<br />

packages and the fair value of the respective membership package and the value-added services cannot be objectively<br />

measured, the aggregate service fees are recognized as revenue ratably over the term of the membership package. In<br />

the event the fair value of the value-added services can be objectively measured, service fees from such value-added<br />

services are recognized as revenue ratably over the contracted service period of the value-added services.<br />

(b) Search revenue<br />

The Group receives service fees from suppliers to enable them to display their storefront/website links or related<br />

information on the search results pages of the Group’s marketplaces after a buyer inputs a particular key word<br />

or phrase into the search box of such marketplaces. Revenue is recognized when a buyer clicks on the suppliers’<br />

storefront/website links or related information, where the positioning of such information and the price for such<br />

positioning are determined through a bidding system.<br />

(c) Transaction fees<br />

In connection with the transaction services, the Group earns revenues from the suppliers or buyers when completing<br />

transactions on the Group’s marketplaces. Revenues related to transaction fees are recognized at the time when the<br />

underlying transaction is completed.<br />

(d) Domain name registration and other service fees<br />

Revenue from registration of domain names is recognized when the related service is rendered and completed.<br />

Revenue from web hosting and application/e-commerce hosting services is recognized ratably over the term of the<br />

contracted services.<br />

(e) Barter transactions<br />

When services are exchanged or swapped for services which are of a similar nature and value, the exchange is not<br />

regarded as a revenue-generating transaction.<br />

When services are rendered in exchange for dissimilar services, the exchange is regarded as a revenue-generating<br />

transaction. The revenue is measured at the fair value of the services received, adjusted by the amount of any cash or<br />

cash equivalents transferred. When the fair value of the services received cannot be measured reliably, the revenue<br />

is measured at the fair value of the services provided in a barter transaction, by reference to non-barter transaction<br />

involving similar services, adjusted by the amount of any cash or cash equivalents transferred.<br />

(f) Interest income<br />

Interest income is recognized on a time-proportion basis using the effective interest method. Interest income is<br />

classified as finance income, net in the consolidated statement of comprehensive income.<br />

The Group is subject to business tax and related surcharges on the revenue earned for services provided in the PRC. The<br />

applicable rate of business tax is 5%. In the consolidated statement of comprehensive income, business tax and related<br />

surcharges for revenue earned by the Group are included in cost of revenue.<br />

101<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010