You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended December 31, 2010<br />

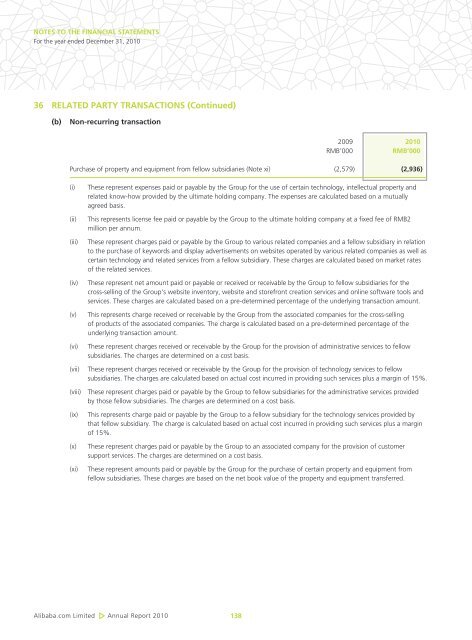

36 RELATED PARTY TRANSACTIONS (Continued)<br />

(b) Non-recurring transaction<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010<br />

138<br />

2009 2010<br />

RMB’000 RMB’000<br />

Purchase of property and equipment from fellow subsidiaries (Note xi) (2,579) (2,936)<br />

(i) These represent expenses paid or payable by the Group for the use of certain technology, intellectual property and<br />

related know-how provided by the ultimate holding company. The expenses are calculated based on a mutually<br />

agreed basis.<br />

(ii) This represents license fee paid or payable by the Group to the ultimate holding company at a fixed fee of RMB2<br />

million per annum.<br />

(iii) These represent charges paid or payable by the Group to various related companies and a fellow subsidiary in relation<br />

to the purchase of keywords and display advertisements on websites operated by various related companies as well as<br />

certain technology and related services from a fellow subsidiary. These charges are calculated based on market rates<br />

of the related services.<br />

(iv) These represent net amount paid or payable or received or receivable by the Group to fellow subsidiaries for the<br />

cross-selling of the Group’s website inventory, website and storefront creation services and online software tools and<br />

services. These charges are calculated based on a pre-determined percentage of the underlying transaction amount.<br />

(v) This represents charge received or receivable by the Group from the associated companies for the cross-selling<br />

of products of the associated companies. The charge is calculated based on a pre-determined percentage of the<br />

underlying transaction amount.<br />

(vi) These represent charges received or receivable by the Group for the provision of administrative services to fellow<br />

subsidiaries. The charges are determined on a cost basis.<br />

(vii) These represent charges received or receivable by the Group for the provision of technology services to fellow<br />

subsidiaries. The charges are calculated based on actual cost incurred in providing such services plus a margin of 15%.<br />

(viii) These represent charges paid or payable by the Group to fellow subsidiaries for the administrative services provided<br />

by those fellow subsidiaries. The charges are determined on a cost basis.<br />

(ix) This represents charge paid or payable by the Group to a fellow subsidiary for the technology services provided by<br />

that fellow subsidiary. The charge is calculated based on actual cost incurred in providing such services plus a margin<br />

of 15%.<br />

(x) These represent charges paid or payable by the Group to an associated company for the provision of customer<br />

support services. The charges are determined on a cost basis.<br />

(xi) These represent amounts paid or payable by the Group for the purchase of certain property and equipment from<br />

fellow subsidiaries. These charges are based on the net book value of the property and equipment transferred.