Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

37 FINANCIAL RISK MANAGEMENT (Continued)<br />

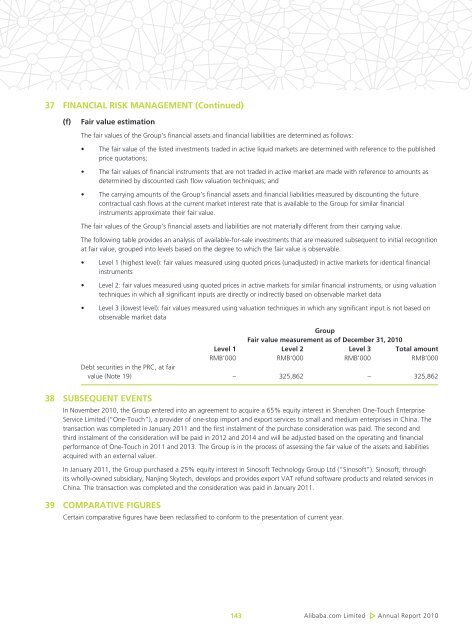

(f) Fair value estimation<br />

The fair values of the Group’s financial assets and financial liabilities are determined as follows:<br />

• The fair value of the listed investments traded in active liquid markets are determined with reference to the published<br />

price quotations;<br />

• The fair values of financial instruments that are not traded in active market are made with reference to amounts as<br />

determined by discounted cash flow valuation techniques; and<br />

• The carrying amounts of the Group’s financial assets and financial liabilities measured by discounting the future<br />

contractual cash flows at the current market interest rate that is available to the Group for similar financial<br />

instruments approximate their fair value.<br />

The fair values of the Group’s financial assets and liabilities are not materially different from their carrying value.<br />

The following table provides an analysis of available-for-sale investments that are measured subsequent to initial recognition<br />

at fair value, grouped into levels based on the degree to which the fair value is observable.<br />

• Level 1 (highest level): fair values measured using quoted prices (unadjusted) in active markets for identical financial<br />

instruments<br />

• Level 2: fair values measured using quoted prices in active markets for similar financial instruments, or using valuation<br />

techniques in which all significant inputs are directly or indirectly based on observable market data<br />

• Level 3 (lowest level): fair values measured using valuation techniques in which any significant input is not based on<br />

observable market data<br />

Group<br />

Fair value measurement as of December 31, 2010<br />

Level 1 Level 2 Level 3 Total amount<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

Debt securities in the PRC, at fair<br />

value (Note 19) – 325,862 – 325,862<br />

38 SUBSEQUENT EVENTS<br />

In November 2010, the Group entered into an agreement to acquire a 65% equity interest in Shenzhen One-Touch Enterprise<br />

Service Limited (“One-Touch”), a provider of one-stop import and export services to small and medium enterprises in China. The<br />

transaction was completed in January 2011 and the first instalment of the purchase consideration was paid. The second and<br />

third instalment of the consideration will be paid in 2012 and 2014 and will be adjusted based on the operating and financial<br />

performance of One-Touch in 2011 and 2013. The Group is in the process of assessing the fair value of the assets and liabilities<br />

acquired with an external valuer.<br />

In January 2011, the Group purchased a 25% equity interest in Sinosoft Technology Group Ltd (“Sinosoft”). Sinosoft, through<br />

its wholly-owned subsidiary, Nanjing Skytech, develops and provides export VAT refund software products and related services in<br />

China. The transaction was completed and the consideration was paid in January 2011.<br />

39 COMPARATIVE FIGURES<br />

Certain comparative figures have been reclassified to conform to the presentation of current year.<br />

143<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010