Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended December 31, 2010<br />

27 SHARE-BASED COMPENSATION (Continued)<br />

(a) Share-based incentive schemes operated by the Group (Continued)<br />

Put options and earn-in arrangement of HiChina<br />

Upon the acquisition of HiChina (Note 1), the Group has granted put options which are exercisable on certain specified<br />

dates over a three-year period from 2011 to 2013, to certain founder shareholders of HiChina. On the condition that<br />

HiChina meets certain post-completion performance milestones, these shareholders may require the Group to further<br />

acquire up to a 14.67% equity interest in HiChina from them for a maximum consideration of RMB104.5 million (US$15.3<br />

million).<br />

In addition, the Group has also agreed, among other things, that it might transfer certain earn-in shares of HiChina to<br />

certain key employees, subject to these employees achieving other post-completion performance milestones to be set based<br />

on the ongoing business strategies and objectives of HiChina on an annual basis over each of the five years starting 2010.<br />

As the vesting of put options is conditional on employment-related elements, the fair value of the put options is recognized<br />

as share-based compensation expense over the vesting period. Similarly, the fair value of the earn-in shares is also accounted<br />

for as share-based compensation expense in the consolidated statement of comprehensive income upon vesting.<br />

Share-based compensation expense for schemes operated by the Group<br />

In 2010, the Group recognized share-based compensation expense of RMB246,532,000 (2009: RMB110,992,000) in<br />

connection with all the share-based incentive schemes operated by the Group.<br />

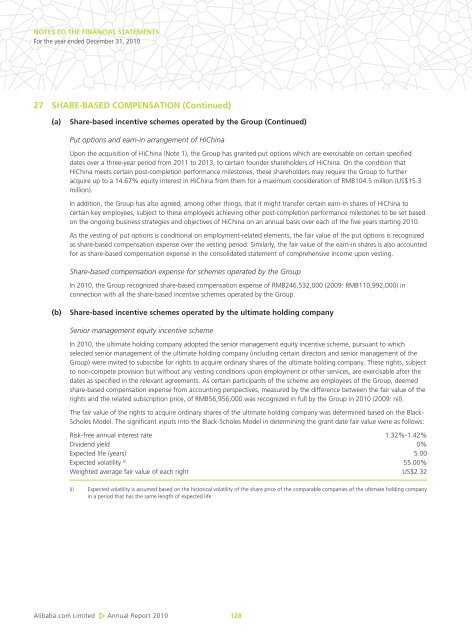

(b) Share-based incentive schemes operated by the ultimate holding company<br />

Senior management equity incentive scheme<br />

In 2010, the ultimate holding company adopted the senior management equity incentive scheme, pursuant to which<br />

selected senior management of the ultimate holding company (including certain directors and senior management of the<br />

Group) were invited to subscribe for rights to acquire ordinary shares of the ultimate holding company. These rights, subject<br />

to non-compete provision but without any vesting conditions upon employment or other services, are exercisable after the<br />

dates as specified in the relevant agreements. As certain participants of the scheme are employees of the Group, deemed<br />

share-based compensation expense from accounting perspectives, measured by the difference between the fair value of the<br />

rights and the related subscription price, of RMB56,956,000 was recognized in full by the Group in 2010 (2009: nil).<br />

The fair value of the rights to acquire ordinary shares of the ultimate holding company was determined based on the Black-<br />

Scholes Model. The significant inputs into the Black-Scholes Model in determining the grant date fair value were as follows:<br />

Risk-free annual interest rate 1.32%-1.42%<br />

Dividend yield 0%<br />

Expected life (years) 5.00<br />

Expected volatility (i) 55.00%<br />

Weighted average fair value of each right US$2.32<br />

(i) Expected volatility is assumed based on the historical volatility of the share price of the comparable companies of the ultimate holding company<br />

in a period that has the same length of expected life.<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010<br />

128