You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

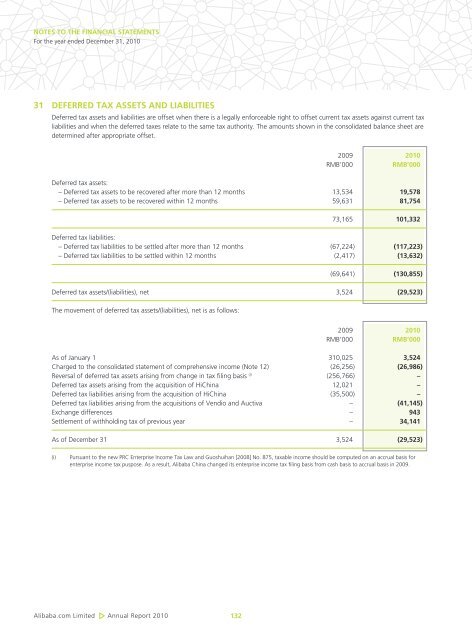

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended December 31, 2010<br />

31 DEFERRED TAX ASSETS AND LIABILITIES<br />

Deferred tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax<br />

liabilities and when the deferred taxes relate to the same tax authority. The amounts shown in the consolidated balance sheet are<br />

determined after appropriate offset.<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010<br />

132<br />

2009 2010<br />

RMB’000 RMB’000<br />

Deferred tax assets:<br />

– Deferred tax assets to be recovered after more than 12 months 13,534 19,578<br />

– Deferred tax assets to be recovered within 12 months 59,631 81,754<br />

73,165 101,332<br />

Deferred tax liabilities:<br />

– Deferred tax liabilities to be settled after more than 12 months (67,224) (117,223)<br />

– Deferred tax liabilities to be settled within 12 months (2,417) (13,632)<br />

(69,641) (130,855)<br />

Deferred tax assets/(liabilities), net 3,524 (29,523)<br />

The movement of deferred tax assets/(liabilities), net is as follows:<br />

2009 2010<br />

RMB’000 RMB’000<br />

As of January 1 310,025 3,524<br />

Charged to the consolidated statement of comprehensive income (Note 12) (26,256) (26,986)<br />

Reversal of deferred tax assets arising from change in tax filing basis (i) (256,766) –<br />

Deferred tax assets arising from the acquisition of HiChina 12,021 –<br />

Deferred tax liabilities arising from the acquisition of HiChina (35,500) –<br />

Deferred tax liabilities arising from the acquisitions of Vendio and Auctiva – (41,145)<br />

Exchange differences – 943<br />

Settlement of withholding tax of previous year – 34,141<br />

As of December 31 3,524 (29,523)<br />

(i) Pursuant to the new PRC Enterprise Income Tax Law and Guoshuihan [2008] No. 875, taxable income should be computed on an accrual basis for<br />

enterprise income tax puspose. As a result, <strong>Alibaba</strong> China changed its enterprise income tax filing basis from cash basis to accrual basis in 2009.