Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended December 31, 2010<br />

37 FINANCIAL RISK MANAGEMENT (Continued)<br />

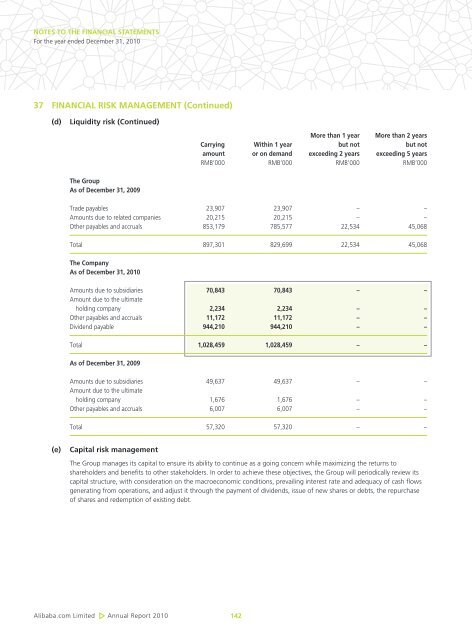

(d) Liquidity risk (Continued)<br />

The Group<br />

As of December 31, 2009<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010<br />

More than 1 year More than 2 years<br />

Carrying within 1 year but not but not<br />

amount or on demand exceeding 2 years exceeding 5 years<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

Trade payables 23,907 23,907 – –<br />

Amounts due to related companies 20,215 20,215 – –<br />

Other payables and accruals 853,179 785,577 22,534 45,068<br />

Total 897,301 829,699 22,534 45,068<br />

The Company<br />

As of December 31, 2010<br />

Amounts due to subsidiaries 70,843 70,843 – –<br />

Amount due to the ultimate<br />

holding company 2,234 2,234 – –<br />

Other payables and accruals 11,172 11,172 – –<br />

Dividend payable 944,210 944,210 – –<br />

Total 1,028,459 1,028,459 – –<br />

As of December 31, 2009<br />

Amounts due to subsidiaries 49,637 49,637 – –<br />

Amount due to the ultimate<br />

holding company 1,676 1,676 – –<br />

Other payables and accruals 6,007 6,007 – –<br />

Total 57,320 57,320 – –<br />

(e) Capital risk management<br />

The Group manages its capital to ensure its ability to continue as a going concern while maximizing the returns to<br />

shareholders and benefits to other stakeholders. In order to achieve these objectives, the Group will periodically review its<br />

capital structure, with consideration on the macroeconomic conditions, prevailing interest rate and adequacy of cash flows<br />

generating from operations, and adjust it through the payment of dividends, issue of new shares or debts, the repurchase<br />

of shares and redemption of existing debt.<br />

142