Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

37 FINANCIAL RISK MANAGEMENT (Continued)<br />

(c) Credit risk<br />

The Group’s credit risk is considered minimal as a substantial part of the income is prepaid by a diversified group of<br />

customers. The extent of the Group’s credit risk exposure is represented by the aggregate of cash and other investments<br />

held at banks and at other financial institutions. All of the Group’s cash and other investments are placed with financial<br />

institutions of sound credit quality and most of which bears maximum original maturities of less than 12 months.<br />

The Group’s maximum exposure to credit risk is represented by the carrying amount of each financial asset in the<br />

consolidated balance sheet.<br />

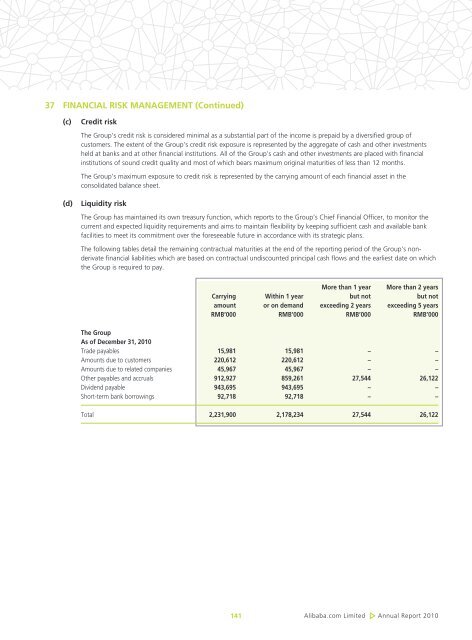

(d) Liquidity risk<br />

The Group has maintained its own treasury function, which reports to the Group’s Chief Financial Officer, to monitor the<br />

current and expected liquidity requirements and aims to maintain flexibility by keeping sufficient cash and available bank<br />

facilities to meet its commitment over the foreseeable future in accordance with its strategic plans.<br />

The following tables detail the remaining contractual maturities at the end of the reporting period of the Group’s nonderivate<br />

financial liabilities which are based on contractual undiscounted principal cash flows and the earliest date on which<br />

the Group is required to pay.<br />

More than 1 year More than 2 years<br />

Carrying within 1 year but not but not<br />

amount or on demand exceeding 2 years exceeding 5 years<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

The Group<br />

As of December 31, 2010<br />

Trade payables 15,981 15,981 – –<br />

Amounts due to customers 220,612 220,612 – –<br />

Amounts due to related companies 45,967 45,967 – –<br />

Other payables and accruals 912,927 859,261 27,544 26,122<br />

Dividend payable 943,695 943,695 – –<br />

Short-term bank borrowings 92,718 92,718 – –<br />

Total 2,231,900 2,178,234 27,544 26,122<br />

141<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010