Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended December 31, 2010<br />

31 DEFERRED TAX ASSETS AND LIABILITIES (Continued)<br />

Deferred tax liabilities (Continued)<br />

Deferred tax assets are recognized for tax losses carried forward to the extent that realization of related tax benefits through<br />

future taxable profits is probable. <strong>Alibaba</strong> China used a tax rate of 15%, which represents a preferential tax rate for enterprises<br />

qualified as High and New Technology Enterprises, in the computation of deferred tax assets as of December 31, 2010 (2009:<br />

15%). In addition, the Group did not recognize deferred tax assets of RMB66,501,000 (2009: RMB40,048,000) primarily in respect<br />

of the accumulated tax losses of subsidiaries incorporated in Hong Kong, Singapore and the United States, and of a branch set up<br />

in Taiwan, subject to the agreement by the relevant tax authorities, amounting to RMB268,835,000 (2009: RMB240,704,000).<br />

These tax losses are allowed to be carried forward to offset against future taxable profits. Carry forward of tax losses in Hong<br />

Kong and Singapore have no time limit, while the tax losses in the United States and Taiwan will expire, if unused, in the following<br />

years:<br />

The United States: Years ending December 31, 2019 through 2030; and<br />

Taiwan: Years ending December 31, 2018 through 2019.<br />

Further, the Group did not recognize deferred tax assets of RMB11,433,000 (2009: RMB23,072,000) in respect of the<br />

accumulated tax losses of subsidiaries incorporated in the PRC, subject to the agreement by the PRC tax authorities, amounting to<br />

RMB48,343,000 (2009: RMB92,289,000). Carry forward of these tax losses will expire, if unused, in the years ending<br />

December 31, 2011 through 2015.<br />

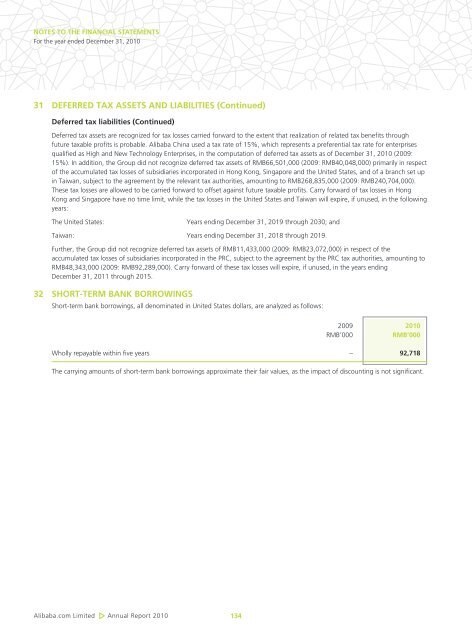

32 SHORT-TERM BANK BORROwINGS<br />

Short-term bank borrowings, all denominated in United States dollars, are analyzed as follows:<br />

<strong>Alibaba</strong>.com Limited Annual <strong>Report</strong> 2010<br />

134<br />

2009 2010<br />

RMB’000 RMB’000<br />

Wholly repayable within five years – 92,718<br />

The carrying amounts of short-term bank borrowings approximate their fair values, as the impact of discounting is not significant.