Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Rating</strong> <strong>Models</strong> <strong>and</strong> <strong>Validation</strong><br />

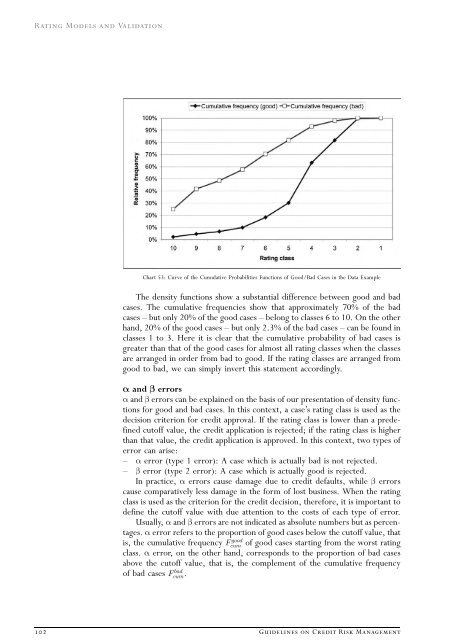

Chart 53: Curve of the Cumulative Probabilities Functions of Good/Bad Cases in the Data Example<br />

The density functions show a substantial difference between good <strong>and</strong> bad<br />

cases. The cumulative frequencies show that approximately 70% of the bad<br />

cases — but only 20% of the good cases — belong to classes 6 to 10. On the other<br />

h<strong>and</strong>, 20% of the good cases — but only 2.3% of the bad cases — can be found in<br />

classes 1 to 3. Here it is clear that the cumulative probability of bad cases is<br />

greater than that of the good cases for almost all rating classes when the classes<br />

are arranged in order from bad to good. If the rating classes are arranged from<br />

good to bad, we can simply invert this statement accordingly.<br />

a <strong>and</strong> b errors<br />

a <strong>and</strong> b errors can be explained on the basis of our presentation of density functions<br />

for good <strong>and</strong> bad cases. In this context, a caseÕs rating class is used as the<br />

decision criterion for credit approval. If the rating class is lower than a predefined<br />

cutoff value, the credit application is rejected; if the rating class is higher<br />

than that value, the credit application is approved. In this context, two types of<br />

error can arise:<br />

— a error (type 1 error): A case which is actually bad is not rejected.<br />

— b error (type 2 error): A case which is actually good is rejected.<br />

In practice, a errors cause damage due to credit defaults, while b errors<br />

cause comparatively less damage in the form of lost business. When the rating<br />

class is used as the criterion for the credit decision, therefore, it is important to<br />

define the cutoff value with due attention to the costs of each type of error.<br />

Usually, a <strong>and</strong> b errors are not indicated as absolute numbers but as percen-<br />

tages. a error refers to the proportion of good cases below the cutoff value, that<br />

is, the cumulative frequency F good<br />

cum of good cases starting from the worst rating<br />

class. a error, on the other h<strong>and</strong>, corresponds to the proportion of bad cases<br />

above the cutoff value, that is, the complement of the cumulative frequency<br />

of bad cases F bad<br />

cum.<br />

102 Guidelines on Credit Risk Management