Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Rating</strong> <strong>Models</strong> <strong>and</strong> <strong>Validation</strong><br />

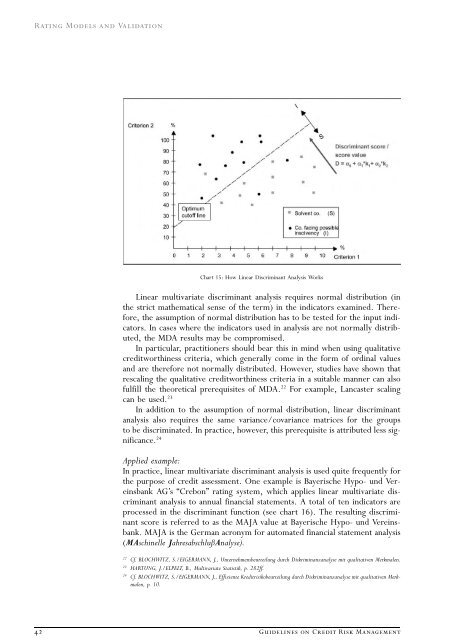

Chart 15: How Linear Discriminant Analysis Works<br />

Linear multivariate discriminant analysis requires normal distribution (in<br />

the strict mathematical sense of the term) in the indicators examined. Therefore,<br />

the assumption of normal distribution has to be tested for the input indicators.<br />

In cases where the indicators used in analysis are not normally distributed,<br />

the MDA results may be compromised.<br />

In particular, practitioners should bear this in mind when using qualitative<br />

creditworthiness criteria, which generally come in the form of ordinal values<br />

<strong>and</strong> are therefore not normally distributed. However, studies have shown that<br />

rescaling the qualitative creditworthiness criteria in a suitable manner can also<br />

fulfill the theoretical prerequisites of MDA. 22 For example, Lancaster scaling<br />

can be used. 23<br />

In addition to the assumption of normal distribution, linear discriminant<br />

analysis also requires the same variance/covariance matrices for the groups<br />

to be discriminated. In practice, however, this prerequisite is attributed less significance.<br />

24<br />

Applied example:<br />

In practice, linear multivariate discriminant analysis is used quite frequently for<br />

the purpose of credit assessment. One example is Bayerische Hypo- und Vereinsbank<br />

AGÕs ÒCrebonÓ rating system, which applies linear multivariate discriminant<br />

analysis to annual financial statements. A total of ten indicators are<br />

processed in the discriminant function (see chart 16). The resulting discriminant<br />

score is referred to as the MAJA value at Bayerische Hypo- und Vereinsbank.<br />

MAJA is the German acronym for automated financial statement analysis<br />

(MAschinelle Jahresabschlu§Analyse).<br />

22 Cf. BLOCHWITZ, S./EIGERMANN, J., Unternehmensbeurteilung durch Diskriminanzanalyse mit qualitativen Merkmalen.<br />

23 HARTUNG, J./ELPELT, B., Multivariate Statistik, p. 282ff.<br />

24 Cf. BLOCHWITZ, S./EIGERMANN, J., Effiziente Kreditrisikobeurteilung durch Diskriminanzanalyse mit qualitativen Merkmalen,<br />

p. 10.<br />

42 Guidelines on Credit Risk Management