Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Rating</strong> <strong>Models</strong> <strong>and</strong> <strong>Validation</strong><br />

The system transforms all of the individual creditworthiness characteristics<br />

into grades <strong>and</strong> then combines them to yield an overall grade. This involves two<br />

steps: First the system compresses grades from an individual information category<br />

into a partial grade by calculating a weighted average. The weights used<br />

here were determined on the basis of expert surveys. Then the system aggregates<br />

individual assessments to generate an overall assessment. The aggregation<br />

process uses the expert systemÕs hierarchical aggregation rules, which the credit<br />

analyst cannot influence.<br />

3.1.4 Fuzzy Logic Systems<br />

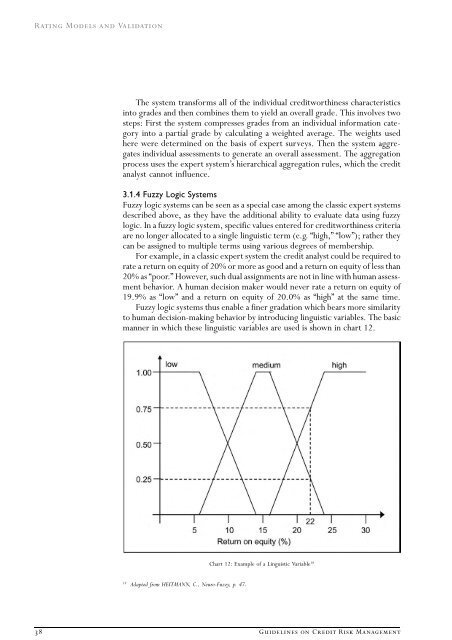

Fuzzy logic systems can be seen as a special case among the classic expert systems<br />

described above, as they have the additional ability to evaluate data using fuzzy<br />

logic. In a fuzzy logic system, specific values entered for creditworthiness criteria<br />

are no longer allocated to a single linguistic term (e.g. Òhigh,Ó ÒlowÓ); rather they<br />

can be assigned to multiple terms using various degrees of membership.<br />

For example, in a classic expert system the credit analyst could be required to<br />

rate a return on equity of 20% or more as good <strong>and</strong> a return on equity of less than<br />

20% as Òpoor.Ó However, such dual assignments are not in line with human assessment<br />

behavior. A human decision maker would never rate a return on equity of<br />

19.9% as ÒlowÓ <strong>and</strong> a return on equity of 20.0% as ÒhighÓ at the same time.<br />

Fuzzy logic systems thus enable a finer gradation which bears more similarity<br />

to human decision-making behavior by introducing linguistic variables. The basic<br />

manner in which these linguistic variables are used is shown in chart 12.<br />

18 Adapted from HEITMANN, C., Neuro-Fuzzy, p. 47.<br />

Chart 12: Example of a Linguistic Variable 18<br />

38 Guidelines on Credit Risk Management