Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

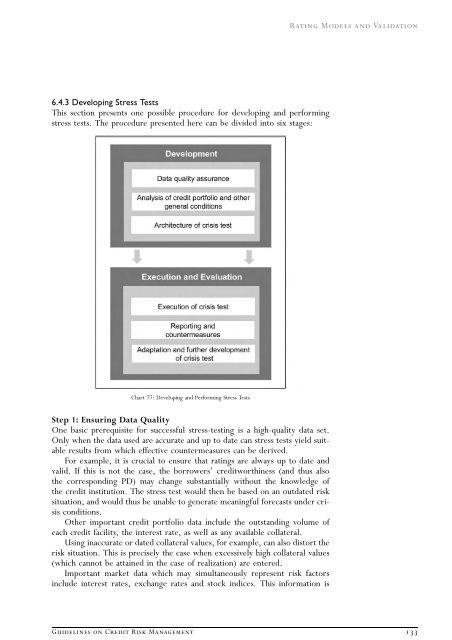

6.4.3 Developing Stress Tests<br />

This section presents one possible procedure for developing <strong>and</strong> performing<br />

stress tests. The procedure presented here can be divided into six stages:<br />

Chart 77: Developing <strong>and</strong> Performing Stress Tests<br />

Step 1: Ensuring Data Quality<br />

One basic prerequisite for successful stress-testing is a high-quality data set.<br />

Only when the data used are accurate <strong>and</strong> up to date can stress tests yield suitable<br />

results from which effective countermeasures can be derived.<br />

For example, it is crucial to ensure that ratings are always up to date <strong>and</strong><br />

valid. If this is not the case, the borrowersÕ creditworthiness (<strong>and</strong> thus also<br />

the corresponding PD) may change substantially without the knowledge of<br />

the credit institution. The stress test would then be based on an outdated risk<br />

situation, <strong>and</strong> would thus be unable to generate meaningful forecasts under crisis<br />

conditions.<br />

Other important credit portfolio data include the outst<strong>and</strong>ing volume of<br />

each credit facility, the interest rate, as well as any available collateral.<br />

Using inaccurate or dated collateral values, for example, can also distort the<br />

risk situation. This is precisely the case when excessively high collateral values<br />

(which cannot be attained in the case of realization) are entered.<br />

Important market data which may simultaneously represent risk factors<br />

include interest rates, exchange rates <strong>and</strong> stock indices. This information is<br />

<strong>Rating</strong> <strong>Models</strong> <strong>and</strong> <strong>Validation</strong><br />

Guidelines on Credit Risk Management 133