Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Rating</strong> <strong>Models</strong> <strong>and</strong> <strong>Validation</strong><br />

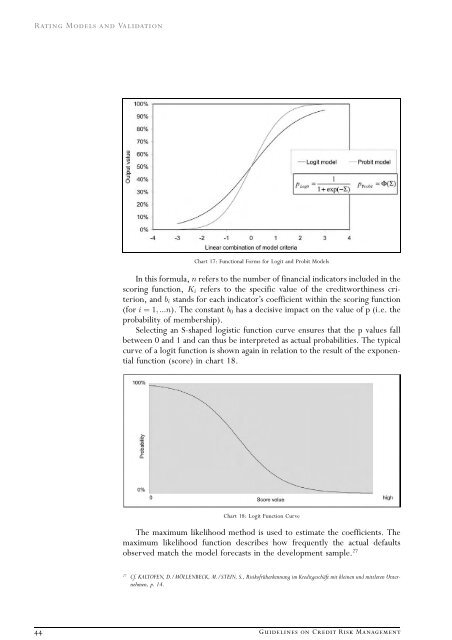

Chart 17: Functional Forms for Logit <strong>and</strong> Probit <strong>Models</strong><br />

In this formula, n refers to the number of financial indicators included in the<br />

scoring function, Ki refers to the specific value of the creditworthiness criterion,<br />

<strong>and</strong> bi st<strong>and</strong>s for each indicatorÕs coefficient within the scoring function<br />

(for i ¼ 1; :::n). The constant b0 has a decisive impact on the value of p (i.e. the<br />

probability of membership).<br />

Selecting an S-shaped logistic function curve ensures that the p values fall<br />

between 0 <strong>and</strong> 1 <strong>and</strong> can thus be interpreted as actual probabilities. The typical<br />

curve of a logit function is shown again in relation to the result of the exponential<br />

function (score) in chart 18.<br />

Chart 18: Logit Function Curve<br />

The maximum likelihood method is used to estimate the coefficients. The<br />

maximum likelihood function describes how frequently the actual defaults<br />

observed match the model forecasts in the development sample. 27<br />

27 Cf. KALTOFEN, D./MO‹LLENBECK, M./STEIN, S., Risikofru‹herkennung im Kreditgescha‹ft mit kleinen und mittleren Unternehmen,<br />

p. 14.<br />

44 Guidelines on Credit Risk Management