Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Rating</strong> <strong>Models</strong> <strong>and</strong> <strong>Validation</strong><br />

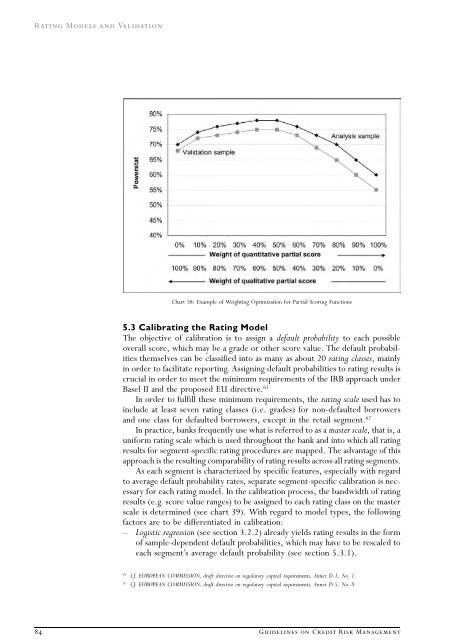

Chart 38: Example of Weighting Optimization for Partial Scoring Functions<br />

5.3 Calibrating the <strong>Rating</strong> Model<br />

The objective of calibration is to assign a default probability to each possible<br />

overall score, which may be a grade or other score value. The default probabilities<br />

themselves can be classified into as many as about 20 rating classes, mainly<br />

in order to facilitate reporting. Assigning default probabilities to rating results is<br />

crucial in order to meet the minimum requirements of the IRB approach under<br />

Basel II <strong>and</strong> the proposed EU directive. 61<br />

In order to fulfill these minimum requirements, the rating scale used has to<br />

include at least seven rating classes (i.e. grades) for non-defaulted borrowers<br />

<strong>and</strong> one class for defaulted borrowers, except in the retail segment. 62<br />

In practice, banks frequently use what is referred to as a master scale, that is, a<br />

uniform rating scale which is used throughout the bank <strong>and</strong> into which all rating<br />

results for segment-specific rating procedures are mapped. The advantage of this<br />

approach is the resulting comparability of rating results across all rating segments.<br />

As each segment is characterized by specific features, especially with regard<br />

to average default probability rates, separate segment-specific calibration is necessary<br />

for each rating model. In the calibration process, the b<strong>and</strong>width of rating<br />

results (e.g. score value ranges) to be assigned to each rating class on the master<br />

scale is determined (see chart 39). With regard to model types, the following<br />

factors are to be differentiated in calibration:<br />

— Logistic regression (see section 3.2.2) already yields rating results in the form<br />

of sample-dependent default probabilities, which may have to be rescaled to<br />

each segmentÕs average default probability (see section 5.3.1).<br />

61 Cf. EUROPEAN COMMISSION, draft directive on regulatory capital requirements, Annex D-1, No. 1.<br />

62 Cf. EUROPEAN COMMISSION, draft directive on regulatory capital requirements, Annex D-5, No. 8.<br />

84 Guidelines on Credit Risk Management