Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

Rating Models and Validation - Oesterreichische Nationalbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

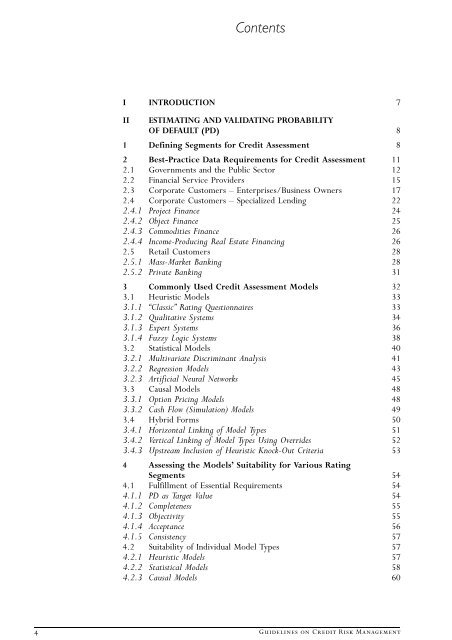

Contents<br />

I INTRODUCTION 7<br />

II ESTIMATING AND VALIDATING PROBABILITY<br />

OF DEFAULT (PD) 8<br />

1 Defining Segments for Credit Assessment 8<br />

2 Best-Practice Data Requirements for Credit Assessment 11<br />

2.1 Governments <strong>and</strong> the Public Sector 12<br />

2.2 Financial Service Providers 15<br />

2.3 Corporate Customers — Enterprises/Business Owners 17<br />

2.4 Corporate Customers — Specialized Lending<br />

2.4.1 Project Finance<br />

2.4.2 Object Finance<br />

2.4.3 Commodities Finance<br />

2.4.4 Income-Producing Real Estate Financing<br />

22<br />

24<br />

25<br />

26<br />

26<br />

2.5 Retail Customers<br />

2.5.1 Mass-Market Banking<br />

2.5.2 Private Banking<br />

28<br />

28<br />

31<br />

3 Commonly Used Credit Assessment <strong>Models</strong> 32<br />

3.1 Heuristic <strong>Models</strong><br />

3.1.1 ÒClassicÓ <strong>Rating</strong> Questionnaires<br />

3.1.2 Qualitative Systems<br />

3.1.3 Expert Systems<br />

3.1.4 Fuzzy Logic Systems<br />

33<br />

33<br />

34<br />

36<br />

38<br />

3.2 Statistical <strong>Models</strong><br />

3.2.1 Multivariate Discriminant Analysis<br />

3.2.2 Regression <strong>Models</strong><br />

3.2.3 Artificial Neural Networks<br />

40<br />

41<br />

43<br />

45<br />

3.3 Causal <strong>Models</strong><br />

3.3.1 Option Pricing <strong>Models</strong><br />

3.3.2 Cash Flow (Simulation) <strong>Models</strong><br />

48<br />

48<br />

49<br />

3.4 Hybrid Forms<br />

3.4.1 Horizontal Linking of Model Types<br />

3.4.2 Vertical Linking of Model Types Using Overrides<br />

3.4.3 Upstream Inclusion of Heuristic Knock-Out Criteria<br />

50<br />

51<br />

52<br />

53<br />

4 Assessing the <strong>Models</strong>Õ Suitability for Various <strong>Rating</strong><br />

Segments 54<br />

4.1 Fulfillment of Essential Requirements<br />

4.1.1 PD as Target Value<br />

4.1.2 Completeness<br />

4.1.3 Objectivity<br />

4.1.4 Acceptance<br />

4.1.5 Consistency<br />

54<br />

54<br />

55<br />

55<br />

56<br />

57<br />

4.2 Suitability of Individual Model Types<br />

4.2.1 Heuristic <strong>Models</strong><br />

4.2.2 Statistical <strong>Models</strong><br />

4.2.3 Causal <strong>Models</strong><br />

57<br />

57<br />

58<br />

60<br />

4 Guidelines on Credit Risk Management