Automation of SACCOs - FSD Kenya

Automation of SACCOs - FSD Kenya

Automation of SACCOs - FSD Kenya

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

for management information purposes. A full write-<strong>of</strong>f is required upon the<br />

following events:<br />

An adverse court ruling disqualifying the <strong>SACCOs</strong> claim on a receivable.<br />

A customer defaults on a loan that is not fully secured, the collateral<br />

cannot be seized or the proceeds do not match the loan value.<br />

When the SACCO has no contractual support for its claim.<br />

The borrower is legally bankrupt.<br />

Recovery efforts are abandoned.<br />

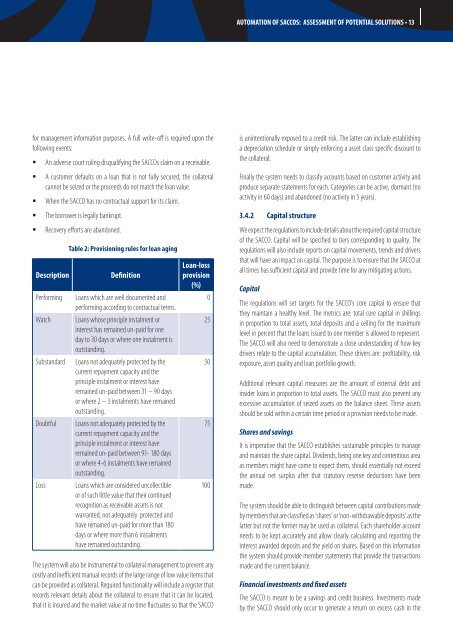

Table 2: Provisioning rules for loan aging<br />

Description Definition<br />

Performing Loans which are well documented and<br />

performing according to contractual terms.<br />

Watch Loans whose principle instalment or<br />

interest has remained un-paid for one<br />

day to 30 days or where one instalment is<br />

outstanding.<br />

Substandard Loans not adequately protected by the<br />

current repayment capacity and the<br />

principle instalment or interest have<br />

remained un-paid between 31 – 90 days<br />

or where 2 – 3 instalments have remained<br />

outstanding.<br />

Doubtful Loans not adequately protected by the<br />

current repayment capacity and the<br />

principle instalment or interest have<br />

remained un-paid between 91- 180 days<br />

or where 4-6 instalments have remained<br />

outstanding.<br />

Loss Loans which are considered uncollectible<br />

or <strong>of</strong> such little value that their continued<br />

recognition as receivable assets is not<br />

warranted, not adequately protected and<br />

have remained un-paid for more than 180<br />

days or where more than 6 instalments<br />

have remained outstanding.<br />

Loan-loss<br />

provision<br />

(%)<br />

0<br />

The system will also be instrumental to collateral management to prevent any<br />

costly and inefficient manual records <strong>of</strong> the large range <strong>of</strong> low value items that<br />

can be provided as collateral. Required functionality will include a register that<br />

records relevant details about the collateral to ensure that it can be located,<br />

that it is insured and the market value at no time fluctuates so that the SACCO<br />

25<br />

50<br />

75<br />

100<br />

AUTOMATION OF SACCOS: ASSESSMENT OF POTENTIAL SOLUTIONS • 13<br />

is unintentionally exposed to a credit risk. The latter can include establishing<br />

a depreciation schedule or simply enforcing a asset class specific discount to<br />

the collateral.<br />

Finally the system needs to classify accounts based on customer activity and<br />

produce separate statements for each. Categories can be active, dormant (no<br />

activity in 60 days) and abandoned (no activity in 5 years).<br />

3.4.2 Capital structure<br />

We expect the regulations to include details about the required capital structure<br />

<strong>of</strong> the SACCO. Capital will be specified to tiers corresponding to quality. The<br />

regulations will also include reports on capital movements, trends and drivers<br />

that will have an impact on capital. The purpose is to ensure that the SACCO at<br />

all times has sufficient capital and provide time for any mitigating actions.<br />

Capital<br />

The regulations will set targets for the SACCO’s core capital to ensure that<br />

they maintain a healthy level. The metrics are: total core capital in shillings<br />

in proportion to total assets, total deposits and a ceiling for the maximum<br />

level in percent that the loans issued to one member is allowed to represent.<br />

The SACCO will also need to demonstrate a close understanding <strong>of</strong> how key<br />

drivers relate to the capital accumulation. These drivers are: pr<strong>of</strong>itability, risk<br />

exposure, asset quality and loan portfolio growth.<br />

Additional relevant capital measures are the amount <strong>of</strong> external debt and<br />

insider loans in proportion to total assets. The SACCO must also prevent any<br />

excessive accumulation <strong>of</strong> seized assets on the balance sheet. These assets<br />

should be sold within a certain time period or a provision needs to be made.<br />

Shares and savings<br />

It is imperative that the SACCO establishes sustainable principles to manage<br />

and maintain the share capital. Dividends, being one key and contentious area<br />

as members might have come to expect them, should essentially not exceed<br />

the annual net surplus after that statutory reserve deductions have been<br />

made.<br />

The system should be able to distinguish between capital contributions made<br />

by members that are classified as ‘shares’ or ‘non-withdrawable deposits’ as the<br />

latter but not the former may be used as collateral. Each shareholder account<br />

needs to be kept accurately and allow clearly calculating and reporting the<br />

interest awarded deposits and the yield on shares. Based on this information<br />

the system should provide member statements that provide the transactions<br />

made and the current balance.<br />

Financial investments and fixed assets<br />

The SACCO is meant to be a savings and credit business. Investments made<br />

by the SACCO should only occur to generate a return on excess cash in the