Automation of SACCOs - FSD Kenya

Automation of SACCOs - FSD Kenya

Automation of SACCOs - FSD Kenya

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

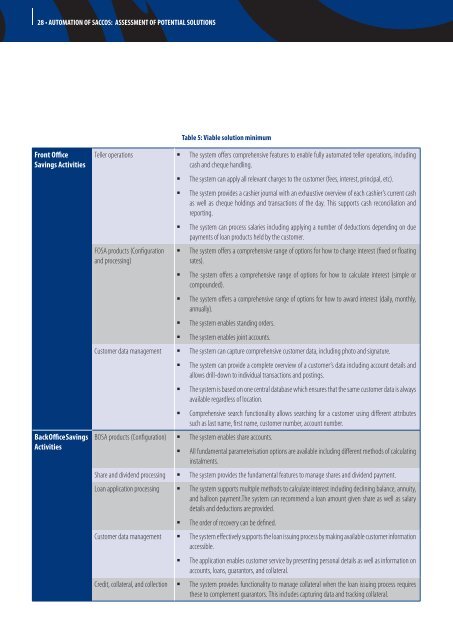

28 • AUTOMATION OF SACCOS: ASSESSMENT OF POTENTIAL SOLUTIONS<br />

Front <strong>of</strong>fice<br />

Savings Activities<br />

Back <strong>of</strong>fice Savings<br />

Activities<br />

Teller operations The system <strong>of</strong>fers comprehensive features to enable fully automated teller operations, including<br />

cash and cheque handling.<br />

The system can apply all relevant charges to the customer (fees, interest, principal, etc).<br />

The system provides a cashier journal with an exhaustive overview <strong>of</strong> each cashier’s current cash<br />

as well as cheque holdings and transactions <strong>of</strong> the day. This supports cash reconciliation and<br />

reporting.<br />

The system can process salaries including applying a number <strong>of</strong> deductions depending on due<br />

payments <strong>of</strong> loan products held by the customer.<br />

FOSA products (Configuration<br />

and processing)<br />

Table 5: Viable solution minimum<br />

The system <strong>of</strong>fers a comprehensive range <strong>of</strong> options for how to charge interest (fixed or floating<br />

rates).<br />

The system <strong>of</strong>fers a comprehensive range <strong>of</strong> options for how to calculate interest (simple or<br />

compounded).<br />

The system <strong>of</strong>fers a comprehensive range <strong>of</strong> options for how to award interest (daily, monthly,<br />

annually).<br />

The system enables standing orders.<br />

The system enables joint accounts.<br />

Customer data management The system can capture comprehensive customer data, including photo and signature.<br />

The system can provide a complete overview <strong>of</strong> a customer’s data including account details and<br />

allows drill-down to individual transactions and postings.<br />

The system is based on one central database which ensures that the same customer data is always<br />

available regardless <strong>of</strong> location.<br />

Comprehensive search functionality allows searching for a customer using different attributes<br />

such as last name, first name, customer number, account number.<br />

BOSA products (Configuration) The system enables share accounts.<br />

All fundamental parameterisation options are available including different methods <strong>of</strong> calculating<br />

instalments.<br />

Share and dividend processing The system provides the fundamental features to manage shares and dividend payment.<br />

Loan application processing The system supports multiple methods to calculate interest including declining balance, annuity,<br />

and balloon payment.The system can recommend a loan amount given share as well as salary<br />

details and deductions are provided.<br />

The order <strong>of</strong> recovery can be defined.<br />

Customer data management The system effectively supports the loan issuing process by making available customer information<br />

accessible.<br />

The application enables customer service by presenting personal details as well as information on<br />

accounts, loans, guarantors, and collateral.<br />

Credit, collateral, and collection The system provides functionality to manage collateral when the loan issuing process requires<br />

these to complement guarantors. This includes capturing data and tracking collateral.