Automation of SACCOs - FSD Kenya

Automation of SACCOs - FSD Kenya

Automation of SACCOs - FSD Kenya

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

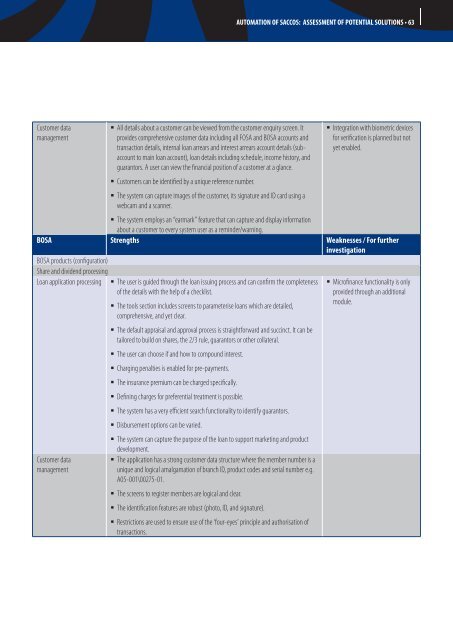

Customer data<br />

management<br />

All details about a customer can be viewed from the customer enquiry screen. It<br />

provides comprehensive customer data including all FOSA and BOSA accounts and<br />

transaction details, internal loan arrears and interest arrears account details (subaccount<br />

to main loan account), loan details including schedule, income history, and<br />

guarantors. A user can view the financial position <strong>of</strong> a customer at a glance.<br />

Customers can be identified by a unique reference number.<br />

The system can capture images <strong>of</strong> the customer, its signature and ID card using a<br />

webcam and a scanner.<br />

The system employs an “earmark” feature that can capture and display information<br />

about a customer to every system user as a reminder/warning.<br />

AUTOMATION OF SACCOS: ASSESSMENT OF POTENTIAL SOLUTIONS • 63<br />

Integration with biometric devices<br />

for verification is planned but not<br />

yet enabled.<br />

BoSA Strengths Weaknesses / For further<br />

investigation<br />

BOSA products (configuration)<br />

Share and dividend processing<br />

Loan application processing The user is guided through the loan issuing process and can confirm the completeness<br />

<strong>of</strong> the details with the help <strong>of</strong> a checklist.<br />

The tools section includes screens to parameterise loans which are detailed,<br />

comprehensive, and yet clear.<br />

The default appraisal and approval process is straightforward and succinct. It can be<br />

tailored to build on shares, the 2/3 rule, guarantors or other collateral.<br />

The user can choose if and how to compound interest.<br />

Charging penalties is enabled for pre-payments.<br />

The insurance premium can be charged specifically.<br />

Defining charges for preferential treatment is possible.<br />

The system has a very efficient search functionality to identify guarantors.<br />

Disbursement options can be varied.<br />

The system can capture the purpose <strong>of</strong> the loan to support marketing and product<br />

development.<br />

Customer data<br />

management<br />

The application has a strong customer data structure where the member number is a<br />

unique and logical amalgamation <strong>of</strong> branch ID, product codes and serial number e.g.<br />

A05-001\00275-01.<br />

The screens to register members are logical and clear.<br />

The identification features are robust (photo, ID, and signature).<br />

Restrictions are used to ensure use <strong>of</strong> the ‘four-eyes’ principle and authorisation <strong>of</strong><br />

transactions.<br />

Micr<strong>of</strong>inance functionality is only<br />

provided through an additional<br />

module.