BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

99<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

25 PROFIT BEFORE TAXATION (CONTINUED)<br />

(b) As a result of the adoption of International Accounting Standard No. 8 (Revised) Net Profit or Loss for<br />

the Period, Fundamental Errors and Changes in Accounting Policies (“IAS 8”) which came into effect<br />

for the accounting period beginning 1 January 1997, these capital transactions are disclosed in this note<br />

and are not taxable. Prior to the introduction of IAS 8, those capital transactions would have been<br />

disclosed as extraordinary items.<br />

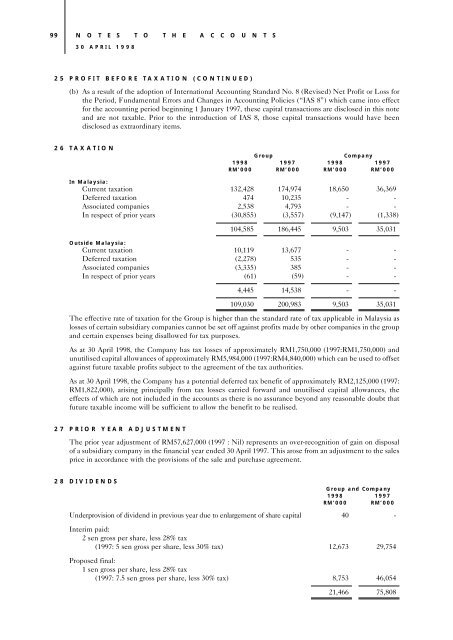

26 TAXATION<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

In Malaysia:<br />

Current taxation 132,428 174,974 18,650 36,369<br />

Deferred taxation 474 10,235 - -<br />

Associated companies 2,538 4,793 - -<br />

In respect of prior years (30,855) (3,557) (9,147) (1,338)<br />

104,585 186,445 9,503 35,031<br />

Outside Malaysia:<br />

Current taxation 10,119 13,677 - -<br />

Deferred taxation (2,278) 535 - -<br />

Associated companies (3,335) 385 - -<br />

In respect of prior years (61) (59) - -<br />

4,445 14,538 - -<br />

109,030 200,983 9,503 35,031<br />

The effective rate of taxation for the Group is higher than the standard rate of tax applicable in Malaysia as<br />

losses of certain subsidiary companies cannot be set off against profits made by other companies in the group<br />

and certain expenses being disallowed for tax purposes.<br />

As at 30 April 1998, the Company has tax losses of approximately RM1,750,000 (1997:RM1,750,000) and<br />

unutilised capital allowances of approximately RM5,984,000 (1997:RM4,840,000) which can be used to offset<br />

against future taxable profits subject to the agreement of the tax authorities.<br />

As at 30 April 1998, the Company has a potential deferred tax benefit of approximately RM2,125,000 (1997:<br />

RM1,822,000), arising principally from tax losses carried forward and unutilised capital allowances, the<br />

effects of which are not included in the accounts as there is no assurance beyond any reasonable doubt that<br />

future taxable income will be sufficient to allow the benefit to be realised.<br />

27 PRIOR YEAR ADJUSTMENT<br />

The prior year adjustment of RM57,627,000 (1997 : Nil) represents an over-recognition of gain on disposal<br />

of a subsidiary company in the financial year ended 30 April 1997. This arose from an adjustment to the sales<br />

price in accordance with the provisions of the sale and purchase agreement.<br />

28 DIVIDENDS<br />

Group and Company<br />

1998 1997<br />

RM’000 RM’000<br />

Underprovision of dividend in previous year due to enlargement of share capital 40 -<br />

Interim paid:<br />

2 sen gross per share, less 28% tax<br />

(1997: 5 sen gross per share, less 30% tax) 12,673 29,754<br />

Proposed final:<br />

1 sen gross per share, less 28% tax<br />

(1997: 7.5 sen gross per share, less 30% tax) 8,753 46,054<br />

21,466 75,808