BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

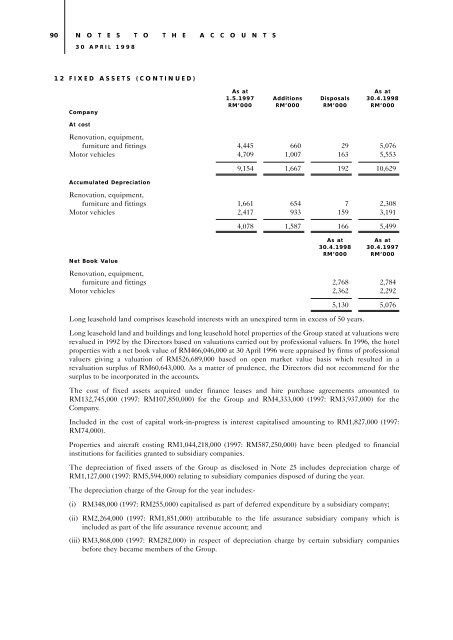

12 FIXED ASSETS (CONTINUED)<br />

Company<br />

As at<br />

As at<br />

1.5.1997 Additions Disposals 30.4.1998<br />

RM’000 RM’000 RM’000 RM’000<br />

At cost<br />

Renovation, equipment,<br />

furniture and fittings 4,445 660 29 5,076<br />

Motor vehicles 4,709 1,007 163 5,553<br />

Accumulated Depreciation<br />

9,154 1,667 192 10,629<br />

Renovation, equipment,<br />

furniture and fittings 1,661 654 7 2,308<br />

Motor vehicles 2,417 933 159 3,191<br />

Net Book Value<br />

4,078 1,587 166 5,499<br />

As at<br />

As at<br />

30.4.1998 30.4.1997<br />

RM’000 RM’000<br />

Renovation, equipment,<br />

furniture and fittings 2,768 2,784<br />

Motor vehicles 2,362 2,292<br />

5,130 5,076<br />

Long leasehold land comprises leasehold interests with an unexpired term in excess of 50 years.<br />

Long leasehold land and buildings and long leasehold hotel properties of the Group stated at valuations were<br />

revalued in 1992 by the Directors based on valuations carried out by professional valuers. In 1996, the hotel<br />

properties with a net book value of RM466,046,000 at 30 April 1996 were appraised by firms of professional<br />

valuers giving a valuation of RM526,689,000 based on open market value basis which resulted in a<br />

revaluation surplus of RM60,643,000. As a matter of prudence, the Directors did not recommend for the<br />

surplus to be incorporated in the accounts.<br />

The cost of fixed assets acquired under finance leases and hire purchase agreements amounted to<br />

RM132,745,000 (1997: RM107,850,000) for the Group and RM4,333,000 (1997: RM3,937,000) for the<br />

Company.<br />

Included in the cost of capital work-in-progress is interest capitalised amounting to RM1,827,000 (1997:<br />

RM74,000).<br />

Properties and aircraft costing RM1,044,218,000 (1997: RM587,250,000) have been pledged to financial<br />

institutions for facilities granted to subsidiary companies.<br />

The depreciation of fixed assets of the Group as disclosed in Note 25 includes depreciation charge of<br />

RM1,127,000 (1997: RM5,594,000) relating to subsidiary companies disposed of during the year.<br />

The depreciation charge of the Group for the year includes:-<br />

(i)<br />

RM348,000 (1997: RM255,000) capitalised as part of deferred expenditure by a subsidiary company;<br />

(ii) RM2,264,000 (1997: RM1,851,000) attributable to the life assurance subsidiary company which is<br />

included as part of the life assurance revenue account; and<br />

(iii) RM3,868,000 (1997: RM282,000) in respect of depreciation charge by certain subsidiary companies<br />

before they became members of the Group.