BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

95<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

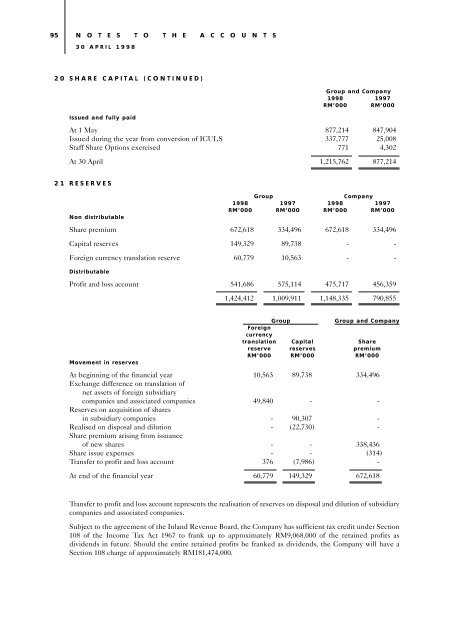

20 SHARE CAPITAL (CONTINUED)<br />

Group and Company<br />

1998 1997<br />

RM’000 RM’000<br />

Issued and fully paid<br />

At 1 May 877,214 847,904<br />

Issued during the year from conversion of ICULS 337,777 25,008<br />

Staff Share Options exercised 771 4,302<br />

At 30 April 1,215,762 877,214<br />

21 RESERVES<br />

Non distributable<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

Share premium 672,618 334,496 672,618 334,496<br />

Capital reserves 149,329 89,738 - -<br />

Foreign currency translation reserve 60,779 10,563 - -<br />

Distributable<br />

Profit and loss account 541,686 575,114 475,717 456,359<br />

1,424,412 1,009,911 1,148,335 790,855<br />

Movement in reserves<br />

Group<br />

Group and Company<br />

Foreign<br />

currency<br />

translation Capital Share<br />

reserve reserves premium<br />

RM’000 RM’000 RM’000<br />

At beginning of the financial year 10,563 89,738 334,496<br />

Exchange difference on translation of<br />

net assets of foreign subsidiary<br />

companies and associated companies 49,840 - -<br />

Reserves on acquisition of shares<br />

in subsidiary companies - 90,307 -<br />

Realised on disposal and dilution - (22,730) -<br />

Share premium arising from issuance<br />

of new shares - - 338,436<br />

Share issue expenses - - (314)<br />

Transfer to profit and loss account 376 (7,986) -<br />

At end of the financial year 60,779 149,329 672,618<br />

Transfer to profit and loss account represents the realisation of reserves on disposal and dilution of subsidiary<br />

companies and associated companies.<br />

Subject to the agreement of the Inland Revenue Board, the Company has sufficient tax credit under Section<br />

108 of the Income Tax Act 1967 to frank up to approximately RM9,068,000 of the retained profits as<br />

dividends in future. Should the entire retained profits be franked as dividends, the Company will have a<br />

Section 108 charge of approximately RM181,474,000.