BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

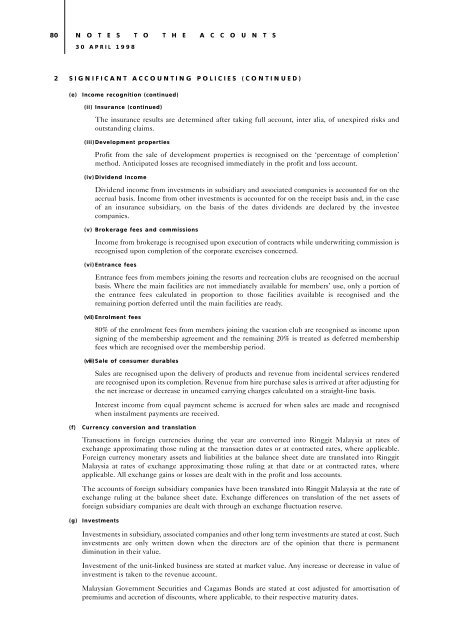

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

2 SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)<br />

(e)<br />

Income recognition (continued)<br />

(ii) Insurance (continued)<br />

The insurance results are determined after taking full account, inter alia, of unexpired risks and<br />

outstanding claims.<br />

(iii)Development properties<br />

Profit from the sale of development properties is recognised on the ‘percentage of completion’<br />

method. Anticipated losses are recognised immediately in the profit and loss account.<br />

(iv)Dividend income<br />

Dividend income from investments in subsidiary and associated companies is accounted for on the<br />

accrual basis. Income from other investments is accounted for on the receipt basis and, in the case<br />

of an insurance subsidiary, on the basis of the dates dividends are declared by the investee<br />

companies.<br />

(v) Brokerage fees and commissions<br />

Income from brokerage is recognised upon execution of contracts while underwriting commission is<br />

recognised upon completion of the corporate exercises concerned.<br />

(vi)Entrance fees<br />

Entrance fees from members joining the resorts and recreation clubs are recognised on the accrual<br />

basis. Where the main facilities are not immediately available for members’ use, only a portion of<br />

the entrance fees calculated in proportion to those facilities available is recognised and the<br />

remaining portion deferred until the main facilities are ready.<br />

(vii) Enrolment fees<br />

80% of the enrolment fees from members joining the vacation club are recognised as income upon<br />

signing of the membership agreement and the remaining 20% is treated as deferred membership<br />

fees which are recognised over the membership period.<br />

(viii) Sale of consumer durables<br />

Sales are recognised upon the delivery of products and revenue from incidental services rendered<br />

are recognised upon its completion. Revenue from hire purchase sales is arrived at after adjusting for<br />

the net increase or decrease in unearned carrying charges calculated on a straight-line basis.<br />

Interest income from equal payment scheme is accrued for when sales are made and recognised<br />

when instalment payments are received.<br />

(f)<br />

Currency conversion and translation<br />

Transactions in foreign currencies during the year are converted into Ringgit Malaysia at rates of<br />

exchange approximating those ruling at the transaction dates or at contracted rates, where applicable.<br />

Foreign currency monetary assets and liabilities at the balance sheet date are translated into Ringgit<br />

Malaysia at rates of exchange approximating those ruling at that date or at contracted rates, where<br />

applicable. All exchange gains or losses are dealt with in the profit and loss accounts.<br />

The accounts of foreign subsidiary companies have been translated into Ringgit Malaysia at the rate of<br />

exchange ruling at the balance sheet date. Exchange differences on translation of the net assets of<br />

foreign subsidiary companies are dealt with through an exchange fluctuation reserve.<br />

(g)<br />

Investments<br />

Investments in subsidiary, associated companies and other long term investments are stated at cost. Such<br />

investments are only written down when the directors are of the opinion that there is permanent<br />

diminution in their value.<br />

Investment of the unit-linked business are stated at market value. Any increase or decrease in value of<br />

investment is taken to the revenue account.<br />

Malaysian Government Securities and Cagamas Bonds are stated at cost adjusted for amortisation of<br />

premiums and accretion of discounts, where applicable, to their respective maturity dates.