BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

82<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

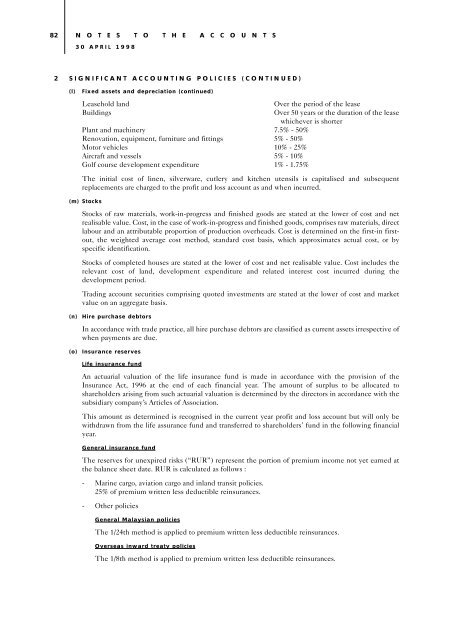

2 SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)<br />

(l)<br />

Fixed assets and depreciation (continued)<br />

Leasehold land<br />

Buildings<br />

Plant and machinery 7.5% - 50%<br />

Renovation, equipment, furniture and fittings 5% - 50%<br />

Motor vehicles 10% - 25%<br />

Aircraft and vessels 5% - 10%<br />

Golf course development expenditure 1% - 1.75%<br />

Over the period of the lease<br />

Over 50 years or the duration of the lease<br />

whichever is shorter<br />

The initial cost of linen, silverware, cutlery and kitchen utensils is capitalised and subsequent<br />

replacements are charged to the profit and loss account as and when incurred.<br />

(m) Stocks<br />

Stocks of raw materials, work-in-progress and finished goods are stated at the lower of cost and net<br />

realisable value. Cost, in the case of work-in-progress and finished goods, comprises raw materials, direct<br />

labour and an attributable proportion of production overheads. Cost is determined on the first-in firstout,<br />

the weighted average cost method, standard cost basis, which approximates actual cost, or by<br />

specific identification.<br />

Stocks of completed houses are stated at the lower of cost and net realisable value. Cost includes the<br />

relevant cost of land, development expenditure and related interest cost incurred during the<br />

development period.<br />

Trading account securities comprising quoted investments are stated at the lower of cost and market<br />

value on an aggregate basis.<br />

(n)<br />

(o)<br />

Hire purchase debtors<br />

In accordance with trade practice, all hire purchase debtors are classified as current assets irrespective of<br />

when payments are due.<br />

Insurance reserves<br />

Life insurance fund<br />

An actuarial valuation of the life insurance fund is made in accordance with the provision of the<br />

Insurance Act, 1996 at the end of each financial year. The amount of surplus to be allocated to<br />

shareholders arising from such actuarial valuation is determined by the directors in accordance with the<br />

subsidiary company’s Articles of Association.<br />

This amount as determined is recognised in the current year profit and loss account but will only be<br />

withdrawn from the life assurance fund and transferred to shareholders’ fund in the following financial<br />

year.<br />

General insurance fund<br />

The reserves for unexpired risks (“RUR”) represent the portion of premium income not yet earned at<br />

the balance sheet date. RUR is calculated as follows :<br />

- Marine cargo, aviation cargo and inland transit policies.<br />

25% of premium written less deductible reinsurances.<br />

- Other policies<br />

General Malaysian policies<br />

The 1/24th method is applied to premium written less deductible reinsurances.<br />

Overseas inward treaty policies<br />

The 1/8th method is applied to premium written less deductible reinsurances.