BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

96<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

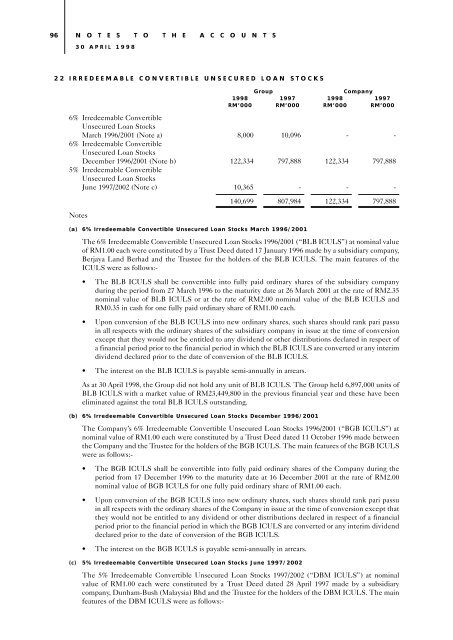

22 IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

6% Irredeemable Convertible<br />

Unsecured Loan Stocks<br />

March 1996/2001 (Note a) 8,000 10,096 - -<br />

6% Irredeemable Convertible<br />

Unsecured Loan Stocks<br />

December 1996/2001 (Note b) 122,334 797,888 122,334 797,888<br />

5% Irredeemable Convertible<br />

Unsecured Loan Stocks<br />

June 1997/2002 (Note c) 10,365 - - -<br />

Notes<br />

(a) 6% Irredeemable Convertible Unsecured Loan Stocks March 1996/2001<br />

140,699 807,984 122,334 797,888<br />

The 6% Irredeemable Convertible Unsecured Loan Stocks 1996/2001 (“BLB ICULS”) at nominal value<br />

of RM1.00 each were constituted by a Trust Deed dated 17 January 1996 made by a subsidiary company,<br />

<strong>Berjaya</strong> Land <strong>Berhad</strong> and the Trustee for the holders of the BLB ICULS. The main features of the<br />

ICULS were as follows:-<br />

• The BLB ICULS shall be convertible into fully paid ordinary shares of the subsidiary company<br />

during the period from 27 March 1996 to the maturity date at 26 March 2001 at the rate of RM2.35<br />

nominal value of BLB ICULS or at the rate of RM2.00 nominal value of the BLB ICULS and<br />

RM0.35 in cash for one fully paid ordinary share of RM1.00 each.<br />

• Upon conversion of the BLB ICULS into new ordinary shares, such shares should rank pari passu<br />

in all respects with the ordinary shares of the subsidiary company in issue at the time of conversion<br />

except that they would not be entitled to any dividend or other distributions declared in respect of<br />

a financial period prior to the financial period in which the BLB ICULS are converted or any interim<br />

dividend declared prior to the date of conversion of the BLB ICULS.<br />

• The interest on the BLB ICULS is payable semi-annually in arrears.<br />

As at 30 April 1998, the Group did not hold any unit of BLB ICULS. The Group held 6,897,000 units of<br />

BLB ICULS with a market value of RM23,449,800 in the previous financial year and these have been<br />

eliminated against the total BLB ICULS outstanding.<br />

(b) 6% Irredeemable Convertible Unsecured Loan Stocks December 1996/2001<br />

The Company’s 6% Irredeemable Convertible Unsecured Loan Stocks 1996/2001 (“BGB ICULS”) at<br />

nominal value of RM1.00 each were constituted by a Trust Deed dated 11 October 1996 made between<br />

the Company and the Trustee for the holders of the BGB ICULS. The main features of the BGB ICULS<br />

were as follows:-<br />

• The BGB ICULS shall be convertible into fully paid ordinary shares of the Company during the<br />

period from 17 December 1996 to the maturity date at 16 December 2001 at the rate of RM2.00<br />

nominal value of BGB ICULS for one fully paid ordinary share of RM1.00 each.<br />

• Upon conversion of the BGB ICULS into new ordinary shares, such shares should rank pari passu<br />

in all respects with the ordinary shares of the Company in issue at the time of conversion except that<br />

they would not be entitled to any dividend or other distributions declared in respect of a financial<br />

period prior to the financial period in which the BGB ICULS are converted or any interim dividend<br />

declared prior to the date of conversion of the BGB ICULS.<br />

• The interest on the BGB ICULS is payable semi-annually in arrears.<br />

(c) 5% Irredeemable Convertible Unsecured Loan Stocks June 1997/2002<br />

The 5% Irredeemable Convertible Unsecured Loan Stocks 1997/2002 (“DBM ICULS”) at nominal<br />

value of RM1.00 each were constituted by a Trust Deed dated 28 April 1997 made by a subsidiary<br />

company, Dunham-Bush (Malaysia) Bhd and the Trustee for the holders of the DBM ICULS. The main<br />

features of the DBM ICULS were as follows:-