BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

92<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

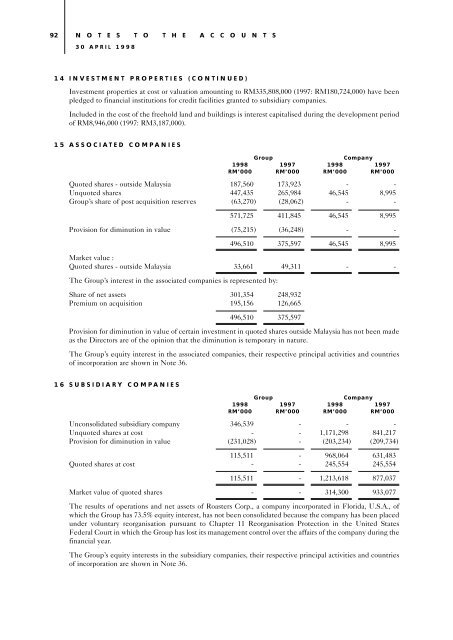

14 INVESTMENT PROPERTIES (CONTINUED)<br />

Investment properties at cost or valuation amounting to RM335,808,000 (1997: RM180,724,000) have been<br />

pledged to financial institutions for credit facilities granted to subsidiary companies.<br />

Included in the cost of the freehold land and buildings is interest capitalised during the development period<br />

of RM8,946,000 (1997: RM3,187,000).<br />

15 ASSOCIATED COMPANIES<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

Quoted shares - outside Malaysia 187,560 173,923 - -<br />

Unquoted shares 447,435 265,984 46,545 8,995<br />

Group’s share of post acquisition reserves (63,270) (28,062) - -<br />

571,725 411,845 46,545 8,995<br />

Provision for diminution in value (75,215) (36,248) - -<br />

496,510 375,597 46,545 8,995<br />

Market value :<br />

Quoted shares - outside Malaysia 33,661 49,311 - -<br />

The Group’s interest in the associated companies is represented by:<br />

Share of net assets 301,354 248,932<br />

Premium on acquisition 195,156 126,665<br />

496,510 375,597<br />

Provision for diminution in value of certain investment in quoted shares outside Malaysia has not been made<br />

as the Directors are of the opinion that the diminution is temporary in nature.<br />

The Group’s equity interest in the associated companies, their respective principal activities and countries<br />

of incorporation are shown in Note 36.<br />

16 SUBSIDIARY COMPANIES<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

Unconsolidated subsidiary company 346,539 - - -<br />

Unquoted shares at cost - - 1,171,298 841,217<br />

Provision for diminution in value (231,028) - (203,234) (209,734)<br />

115,511 - 968,064 631,483<br />

Quoted shares at cost - - 245,554 245,554<br />

115,511 - 1,213,618 877,037<br />

Market value of quoted shares - - 314,300 933,077<br />

The results of operations and net assets of Roasters Corp., a company incorporated in Florida, U.S.A., of<br />

which the Group has 73.5% equity interest, has not been consolidated because the company has been placed<br />

under voluntary reorganisation pursuant to Chapter 11 Reorganisation Protection in the United States<br />

Federal Court in which the Group has lost its management control over the affairs of the company during the<br />

financial year.<br />

The Group’s equity interests in the subsidiary companies, their respective principal activities and countries<br />

of incorporation are shown in Note 36.