BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

91<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

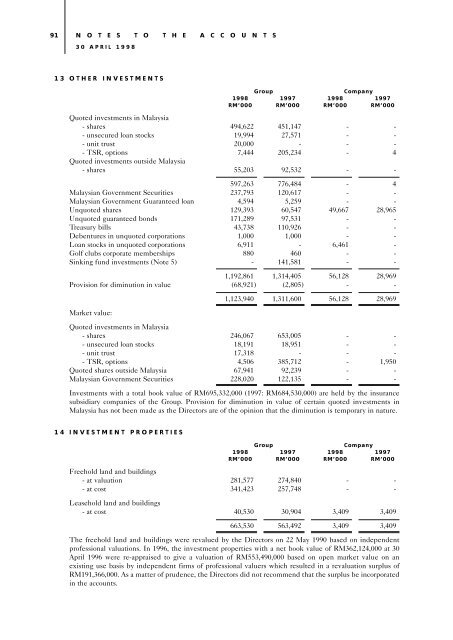

13 OTHER INVESTMENTS<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

Quoted investments in Malaysia<br />

- shares 494,622 451,147 - -<br />

- unsecured loan stocks 19,994 27,571 - -<br />

- unit trust 20,000 - - -<br />

- TSR, options 7,444 205,234 - 4<br />

Quoted investments outside Malaysia<br />

- shares 55,203 92,532 - -<br />

597,263 776,484 - 4<br />

Malaysian Government Securities 237,793 120,617 - -<br />

Malaysian Government Guaranteed loan 4,594 5,259 - -<br />

Unquoted shares 129,393 60,547 49,667 28,965<br />

Unquoted guaranteed bonds 171,289 97,531 - -<br />

Treasury bills 43,738 110,926 - -<br />

Debentures in unquoted corporations 1,000 1,000 - -<br />

Loan stocks in unquoted corporations 6,911 - 6,461 -<br />

Golf clubs corporate memberships 880 460 - -<br />

Sinking fund investments (Note 5) - 141,581 - -<br />

1,192,861 1,314,405 56,128 28,969<br />

Provision for diminution in value (68,921) (2,805) - -<br />

Market value:<br />

1,123,940 1,311,600 56,128 28,969<br />

Quoted investments in Malaysia<br />

- shares 246,067 653,005 - -<br />

- unsecured loan stocks 18,191 18,951 - -<br />

- unit trust 17,318 - - -<br />

- TSR, options 4,506 385,712 - 1,950<br />

Quoted shares outside Malaysia 67,941 92,239 - -<br />

Malaysian Government Securities 228,020 122,135 - -<br />

Investments with a total book value of RM695,332,000 (1997: RM684,530,000) are held by the insurance<br />

subsidiary companies of the Group. Provision for diminution in value of certain quoted investments in<br />

Malaysia has not been made as the Directors are of the opinion that the diminution is temporary in nature.<br />

14 INVESTMENT PROPERTIES<br />

Group<br />

Company<br />

1998 1997 1998 1997<br />

RM’000 RM’000 RM’000 RM’000<br />

Freehold land and buildings<br />

- at valuation 281,577 274,840 - -<br />

- at cost 341,423 257,748 - -<br />

Leasehold land and buildings<br />

- at cost 40,530 30,904 3,409 3,409<br />

663,530 563,492 3,409 3,409<br />

The freehold land and buildings were revalued by the Directors on 22 May 1990 based on independent<br />

professional valuations. In 1996, the investment properties with a net book value of RM362,124,000 at 30<br />

April 1996 were re-appraised to give a valuation of RM553,490,000 based on open market value on an<br />

existing use basis by independent firms of professional valuers which resulted in a revaluation surplus of<br />

RM191,366,000. As a matter of prudence, the Directors did not recommend that the surplus be incorporated<br />

in the accounts.