BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

BERJAYA GROUP BERHAD - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

88<br />

N O T E S T O T H E A C C O U N T S<br />

30 APRIL 1998<br />

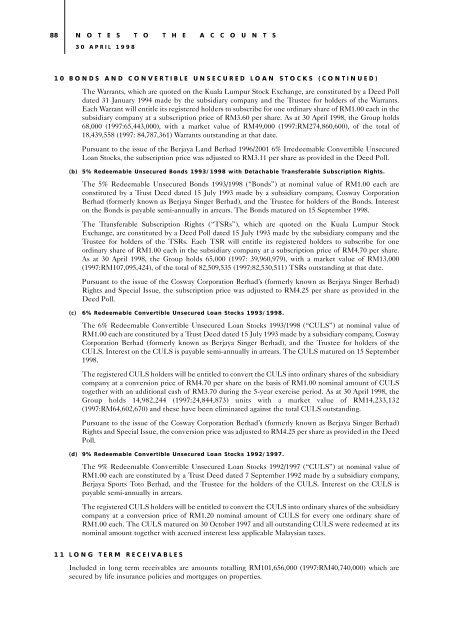

10 BONDS AND CONVERTIBLE UNSECURED LOAN STOCKS (CONTINUED)<br />

The Warrants, which are quoted on the Kuala Lumpur Stock Exchange, are constituted by a Deed Poll<br />

dated 31 January 1994 made by the subsidiary company and the Trustee for holders of the Warrants.<br />

Each Warrant will entitle its registered holders to subscribe for one ordinary share of RM1.00 each in the<br />

subsidiary company at a subscription price of RM3.60 per share. As at 30 April 1998, the Group holds<br />

68,000 (1997:65,443,000), with a market value of RM49,000 (1997:RM274,860,600), of the total of<br />

18,439,558 (1997: 84,787,361) Warrants outstanding at that date.<br />

Pursuant to the issue of the <strong>Berjaya</strong> Land <strong>Berhad</strong> 1996/2001 6% Irredeemable Convertible Unsecured<br />

Loan Stocks, the subscription price was adjusted to RM3.11 per share as provided in the Deed Poll.<br />

(b)<br />

5% Redeemable Unsecured Bonds 1993/1998 with Detachable Transferable Subscription Rights.<br />

The 5% Redeemable Unsecured Bonds 1993/1998 (“Bonds”) at nominal value of RM1.00 each are<br />

constituted by a Trust Deed dated 15 July 1993 made by a subsidiary company, Cosway <strong>Corporation</strong><br />

<strong>Berhad</strong> (formerly known as <strong>Berjaya</strong> Singer <strong>Berhad</strong>), and the Trustee for holders of the Bonds. Interest<br />

on the Bonds is payable semi-annually in arrears. The Bonds matured on 15 September 1998.<br />

The Transferable Subscription Rights (“TSRs”), which are quoted on the Kuala Lumpur Stock<br />

Exchange, are constituted by a Deed Poll dated 15 July 1993 made by the subsidiary company and the<br />

Trustee for holders of the TSRs. Each TSR will entitle its registered holders to subscribe for one<br />

ordinary share of RM1.00 each in the subsidiary company at a subscription price of RM4.70 per share.<br />

As at 30 April 1998, the Group holds 65,000 (1997: 39,960,979), with a market value of RM13,000<br />

(1997:RM107,095,424), of the total of 82,509,535 (1997:82,530,511) TSRs outstanding at that date.<br />

Pursuant to the issue of the Cosway <strong>Corporation</strong> <strong>Berhad</strong>’s (formerly known as <strong>Berjaya</strong> Singer <strong>Berhad</strong>)<br />

Rights and Special Issue, the subscription price was adjusted to RM4.25 per share as provided in the<br />

Deed Poll.<br />

(c) 6% Redeemable Convertible Unsecured Loan Stocks 1993/1998.<br />

The 6% Redeemable Convertible Unsecured Loan Stocks 1993/1998 (“CULS”) at nominal value of<br />

RM1.00 each are constituted by a Trust Deed dated 15 July 1993 made by a subsidiary company, Cosway<br />

<strong>Corporation</strong> <strong>Berhad</strong> (formerly known as <strong>Berjaya</strong> Singer <strong>Berhad</strong>), and the Trustee for holders of the<br />

CULS. Interest on the CULS is payable semi-annually in arrears. The CULS matured on 15 September<br />

1998.<br />

The registered CULS holders will be entitled to convert the CULS into ordinary shares of the subsidiary<br />

company at a conversion price of RM4.70 per share on the basis of RM1.00 nominal amount of CULS<br />

together with an additional cash of RM3.70 during the 5-year exercise period. As at 30 April 1998, the<br />

Group holds 14,982,244 (1997:24,844,873) units with a market value of RM14,233,132<br />

(1997:RM64,602,670) and these have been eliminated against the total CULS outstanding.<br />

Pursuant to the issue of the Cosway <strong>Corporation</strong> <strong>Berhad</strong>’s (formerly known as <strong>Berjaya</strong> Singer <strong>Berhad</strong>)<br />

Rights and Special Issue, the conversion price was adjusted to RM4.25 per share as provided in the Deed<br />

Poll.<br />

(d) 9% Redeemable Convertible Unsecured Loan Stocks 1992/1997.<br />

The 9% Redeemable Convertible Unsecured Loan Stocks 1992/1997 (“CULS”) at nominal value of<br />

RM1.00 each are constituted by a Trust Deed dated 7 September 1992 made by a subsidiary company,<br />

<strong>Berjaya</strong> Sports Toto <strong>Berhad</strong>, and the Trustee for the holders of the CULS. Interest on the CULS is<br />

payable semi-annually in arrears.<br />

The registered CULS holders will be entitled to convert the CULS into ordinary shares of the subsidiary<br />

company at a conversion price of RM1.20 nominal amount of CULS for every one ordinary share of<br />

RM1.00 each. The CULS matured on 30 October 1997 and all outstanding CULS were redeemed at its<br />

nominal amount together with accrued interest less applicable Malaysian taxes.<br />

11 LONG TERM RECEIVABLES<br />

Included in long term receivables are amounts totalling RM101,656,000 (1997:RM40,740,000) which are<br />

secured by life insurance policies and mortgages on properties.