Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

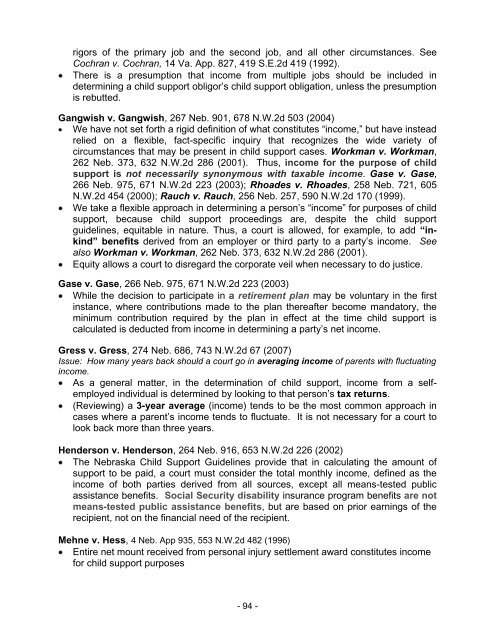

igors of the primary job and the second job, and all other circumstances. See<br />

Cochran v. Cochran, 14 Va. App. 827, 419 S.E.2d 419 (1992).<br />

There is a presumption that income from multiple jobs should be included in<br />

determining a child support obligor’s child support obligation, unless the presumption<br />

is rebutted.<br />

Gangwish v. Gangwish, 267 Neb. 901, 678 N.W.2d 503 (2004)<br />

We have not set forth a rigid definition of what constitutes “income,” but have instead<br />

relied on a flexible, fact-specific inquiry that recognizes the wide variety of<br />

circumstances that may be present in child support cases. Workman v. Workman,<br />

262 Neb. 373, 632 N.W.2d 286 (2001). Thus, income for the purpose of child<br />

support is not necessarily synonymous with taxable income. Gase v. Gase,<br />

266 Neb. 975, 671 N.W.2d 223 (2003); Rhoades v. Rhoades, 258 Neb. 721, 605<br />

N.W.2d 454 (2000); Rauch v. Rauch, 256 Neb. 257, 590 N.W.2d 170 (1999).<br />

We take a flexible approach in determining a person’s “income” for purposes of child<br />

support, because child support proceedings are, despite the child support<br />

guidelines, equitable in nature. Thus, a court is allowed, for example, to add “inkind”<br />

benefits derived from an employer or third party to a party’s income. See<br />

also Workman v. Workman, 262 Neb. 373, 632 N.W.2d 286 (2001).<br />

Equity allows a court to disregard the corporate veil when necessary to do justice.<br />

Gase v. Gase, 266 Neb. 975, 671 N.W.2d 223 (2003)<br />

While the decision to participate in a retirement plan may be voluntary in the first<br />

instance, where contributions made to the plan thereafter become mandatory, the<br />

minimum contribution required by the plan in effect at the time child support is<br />

calculated is deducted from income in determining a party’s net income.<br />

Gress v. Gress, 274 Neb. 686, 743 N.W.2d 67 (2007)<br />

Issue: How many years back should a court go in averaging income of parents with fluctuating<br />

income.<br />

As a general matter, in the determination of child support, income from a selfemployed<br />

individual is determined by looking to that person’s tax returns.<br />

(Reviewing) a 3-year average (income) tends to be the most common approach in<br />

cases where a parent’s income tends to fluctuate. It is not necessary for a court to<br />

look back more than three years.<br />

Henderson v. Henderson, 264 Neb. 916, 653 N.W.2d 226 (2002)<br />

The <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines provide that in calculating the amount of<br />

support to be paid, a court must consider the total monthly income, defined as the<br />

income of both parties derived from all sources, except all means-tested public<br />

assistance benefits. Social Security disability insurance program benefits are not<br />

means-tested public assistance benefits, but are based on prior earnings of the<br />

recipient, not on the financial need of the recipient.<br />

Mehne v. Hess, 4 Neb. App 935, 553 N.W.2d 482 (1996)<br />

Entire net mount received from personal injury settlement award constitutes income<br />

for child support purposes<br />

- 94 -